United Healthcare 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

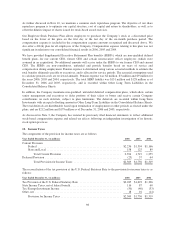

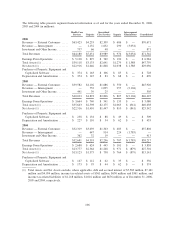

CONSOLIDATED QUARTERLY STATEMENTS OF OPERATIONS

For the Quarter Ended December 31, 2005

APB 25 — Historical Accounting Method FAS 123R — Current Accounting Method

(in millions, except per share data) As Reported Adjustments (1) As Restated Adoption (2) Adjustments (3) As Restated

Revenues

Premiums ................. $10,880 $ 243 $11,123 $ — $ — $11,123

Services ................... 1,044 (80) 964 — — 964

Products .................. — 78 78 — — 78

Investment and Other

Income ................. 121 — 121 — — 121

Total Revenues ......... 12,045 241 12,286 — — 12,286

Operating Costs

Medical Costs .............. 8,624 259 8,883 — — 8,883

Operating Costs ............ 1,872 66 1,938 (11) 14 1,941

Cost of Products Sold ........ — 45 45 — — 45

Depreciation and

Amortization ............. 120 — 120 — — 120

Total Operating Costs .... 10,616 370 10,986 (11) 14 10,989

Earnings From Operations ...... 1,429 (129) 1,300 11 (14) 1,297

Interest Expense ............ (75) — (75) — — (75)

Earnings Before Income Taxes . . . 1,354 (129) 1,225 11 (14) 1,222

Provision for Income Taxes . . . (484) 35 (449) 3 2 (444)

Net Earnings .................. $ 870 $ (94) $ 776 $ 14 $ (12) $ 778

Basic Net Earnings per Common

Share ...................... $ 0.69 $(0.08) $ 0.61 $0.01 $(0.01) $ 0.61

Diluted Net Earnings per

Common Share .............. $ 0.65 $(0.07) $ 0.58 $0.01 $(0.01) $ 0.58

Basic Weighted-Average Number

of Common Shares

Outstanding ................. 1,271 — 1,271 — — 1,271

Dilutive Effect of Common Stock

Equivalents ................. 67 (2) 65 2 4 71

Diluted Weighted-Average

Number of Common Shares

Outstanding ................. 1,338 (2) 1,336 2 4 1,342

(1) Includes $78 million of stock-based compensation and $21 million of deferred tax benefit associated with

the restatement of our historical APB 25 Consolidated Statement of Operations as well as an adjustment to

premium revenue of $280 million, medical costs of $256 million and operating costs of $24 million to

reflect a reinsurance contract on a gross basis. We have also reclassified certain service revenues and

operating costs to product revenues and cost of products sold, respectively, primarily related to our

pharmacy benefit management business acquired as part of the PacifiCare acquisition in December 2005 in

order to conform to our current presentation.

(2) Reflects $67 million of stock-based compensation and $24 million of deferred tax benefit as recorded under

the modified retrospective method of adoption of FAS 123R, net of the restatement adjustments under APB

25.

(3) Represents adjustments made to restate our Consolidated Statement of Operations subsequent to the

adoption of FAS 123R under the modified retrospective method of adoption and includes $14 million of

additional stock-based compensation and $2 million of related deferred tax benefit.

108