United Healthcare 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We record liabilities related to integration activities in connection with business combinations when integration

plans are finalized and approved by management within one year of the acquisition date in accordance with the

requirements of the Emerging Issues Task Force (EITF) Issue No. 95-3, “Recognition of Liabilities in

Connection with a Purchase Business Combination.” Liabilities recorded relate to activities that have no future

economic benefit to the Company and represent contractual obligations. These liabilities result in an increase to

goodwill acquired. At each reporting date, we evaluate our liabilities associated with integration activities and

make adjustments as appropriate. Integration activities relate primarily to severance costs for certain workforce

reductions largely in the Health Care Services segment, costs of terminated or vacated leased facilities and other

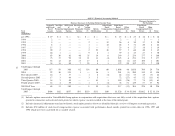

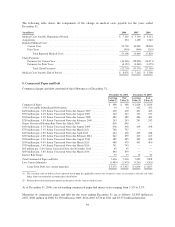

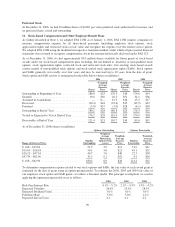

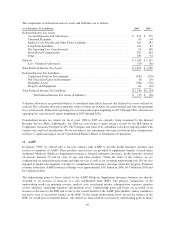

contract termination costs. The following table illustrates the changes in employee termination benefit costs and

other integration costs related to the PacifiCare acquisition as of December 31, 2006 (in millions):

Employee

Termination

Benefit Costs

Other Integration

Activities Total

Accrued integration liabilities at December 31, 2005 .... $ 15 $ 30 $ 45

Additional integration costs accrued and estimate

adjustments .................................. 55 3 58

Payments made against liability .................... (43) (5) (48)

Accrued integration liabilities at December 31,2006 .... $ 27 $ 28 $ 55

On September 19, 2005, our Health Care Services business segment acquired Neighborhood Health Partnership

(NHP). NHP serves local employers primarily in South Florida. This acquisition strengthened our market

position in this region and provided expanded distribution opportunities for our other UnitedHealth Group

businesses. We paid approximately $185 million in cash in exchange for all of the outstanding equity of NHP.

The results of operations and financial condition of NHP have been included in our Consolidated Financial

Statements since the acquisition date. The pro forma effects of the NHP acquisition on our Consolidated

Financial Statements were not material.

In October 2005, we sold the life insurance and annuity business within Golden Rule to OneAmerica Financial

Partners, Inc. (OneAmerica) through an indemnity reinsurance arrangement. Under the arrangement,

OneAmerica assumes the risks associated with the future policy benefits for the life and annuity contracts. We

remain liable for claims if OneAmerica fails to meet its obligations to policy holders. Because we remain

primarily liable to the policy holders, the liabilities and obligations associated with the reinsured contracts remain

on our Consolidated Balance Sheets with a corresponding reinsurance receivable from OneAmerica, which is

classified in other current and noncurrent assets and totaled approximately $121 million and $1.9 billion,

respectively, as of December 31, 2006. We transferred approximately $1.3 billion of investments and $363

million in cash to OneAmerica in conjunction with the arrangement. We realized a small gain on the sale which

has been deferred and is being amortized over the estimated remaining life of the reinsured contracts.

For the years ended December 31, 2006, 2005 and 2004, aggregate consideration paid or issued for smaller

acquisitions accounted for under the purchase method was $276 million, $196 million and $158 million,

respectively. These acquisitions were not material to our Consolidated Financial Statements.

89