United Healthcare 2006 Annual Report Download - page 106

Download and view the complete annual report

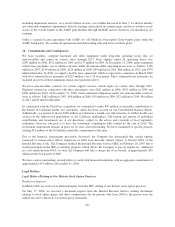

Please find page 106 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for failure to timely reimburse providers for medical services rendered. The consolidated suits seek injunctive,

compensatory and equitable relief as well as restitution, costs, fees and interest payments. The trial court granted

the health care providers’ motion for class certification and that order was reviewed by the Eleventh Circuit

Court of Appeals. The Eleventh Circuit affirmed the class action status of the RICO claims, but reversed as to the

breach of contract, unjust enrichment and prompt payment claims. During the course of the litigation, there have

been co-defendant settlements. On January 31, 2006, the trial court dismissed all remaining claims against

PacifiCare, and on June 19, 2006, the trial court dismissed all remaining claims against UnitedHealthcare brought

by the lead plaintiff. The tag-along lawsuits remain outstanding. On July 27, 2006, the plaintiffs filed a notice of

appeal to the Eleventh Circuit Court of Appeals challenging the dismissal of the claims against UnitedHealthcare.

We intend to vigorously defend against the action.

On March 15, 2000, the American Medical Association filed a lawsuit against the Company in the Supreme

Court of the State of New York, County of New York. On April 13, 2000, we removed this case to the

United States District Court for the Southern District of New York. The suit alleges causes of action based on

ERISA, as well as breach of contract and the implied covenant of good faith and fair dealing, deceptive acts and

practices, and trade libel in connection with the calculation of reasonable and customary reimbursement rates for

non-network providers. The suit seeks declaratory, injunctive and compensatory relief as well as costs, fees and

interest payments. An amended complaint was filed on August 25, 2000, which alleged two classes of plaintiffs,

an ERISA class and a non-ERISA class. After the Court dismissed certain ERISA claims and the claims brought

by the American Medical Association, a third amended complaint was filed on January 11, 2002. On October 25,

2002, the court granted in part and denied in part our motion to dismiss the third amended complaint. On May 21,

2003, we filed a counterclaim complaint in this matter alleging antitrust violations against the American Medical

Association and asserting claims based on improper billing practices against an individual provider plaintiff. On

May 26, 2004, we filed a motion for partial summary judgment seeking the dismissal of certain claims and

parties based, in part, due to lack of standing. On July 16, 2004, plaintiffs filed a motion for leave to file an

amended complaint, seeking to assert RICO violations. On December 29, 2006, the trial court granted plaintiffs’

motion to amend the complaint. We intend to vigorously defend against the action.

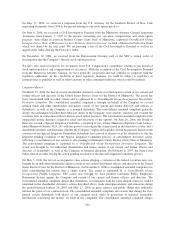

Government Regulation

Our business is regulated at federal, state, local and international levels. The laws and rules governing our

business and interpretations of those laws and rules are subject to frequent change. Broad latitude is given to the

agencies administering those regulations. State legislatures and Congress continue to focus on health care issues

as the subject of proposed legislation. Existing or future laws and rules could force us to change how we do

business, restrict revenue and enrollment growth, increase our health care and administrative costs and capital

requirements, and increase our liability in federal and state courts for coverage determinations, contract

interpretation and other actions. Further, we must obtain and maintain regulatory approvals to market many of

our products.

We typically have been and are currently involved in various governmental investigations, audits and reviews.

These include routine, regular and special investigations, audits, and reviews by CMS, state insurance and health

and welfare departments, state attorneys general, the Office of the Inspector General, the Office of

Personnel Management, the Office of Civil Rights, U.S. Congressional committees, the U.S. Department of

Justice and U.S. Attorneys. Such government actions can result in assessment of damages, civil or criminal fines

or penalties, or other sanctions, including loss of licensure or exclusion from participation in government

programs. We also are subject to a formal investigation of our historic stock option practices by the SEC, Internal

Revenue Service, U.S. Attorney for the Southern District of New York, Minnesota Attorney General, and a

related review by the Special Litigation Committee of the Company, and we have received requests for

documents from U.S. Congressional committees. With the exception of the Civil Investigative Demand from the

Minnesota Attorney General, we generally have cooperated and will continue to cooperate with the regulatory

authorities. At the conclusion of these regulatory inquiries, we could be subject to regulatory or criminal fines or

penalties as well as other sanctions or other contingent liabilities, which could be material.

104