United Healthcare 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

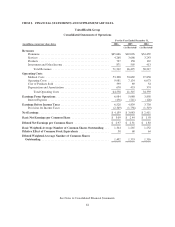

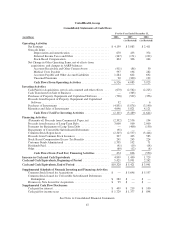

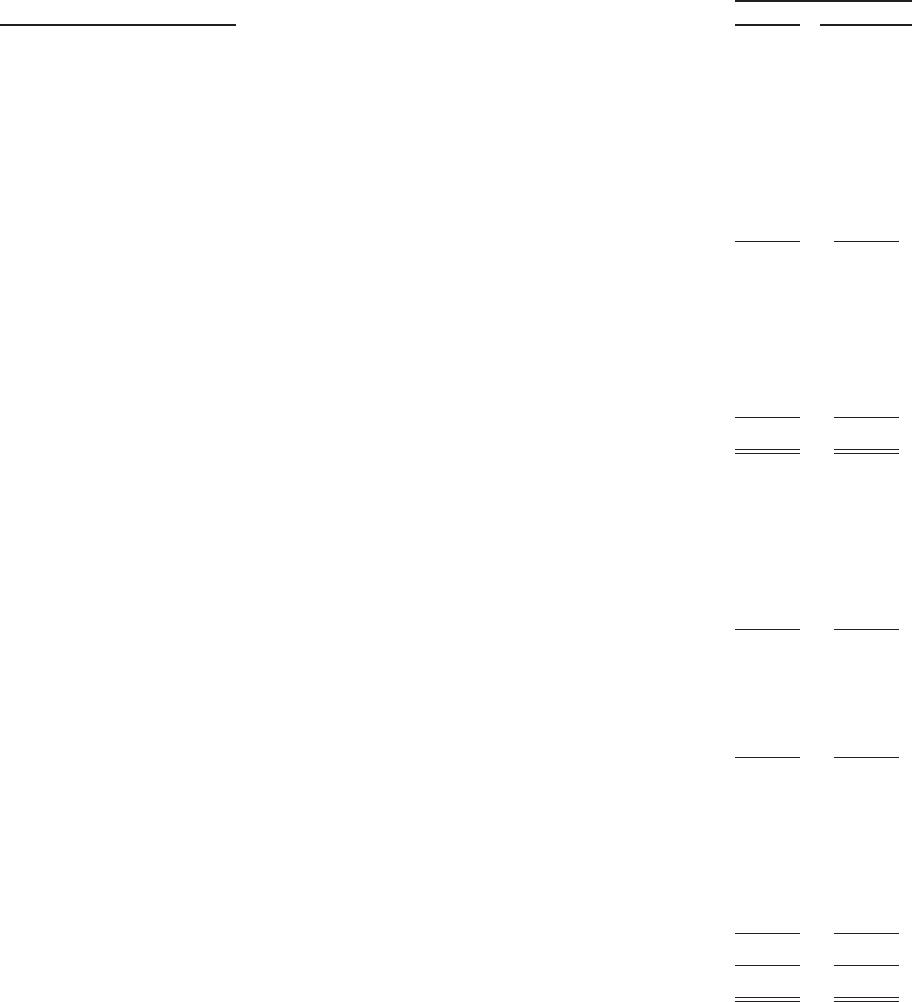

UnitedHealth Group

Consolidated Balance Sheets

As of December 31,

(in millions, except per share data) 2006 2005

(As Restated)

Assets

Current Assets

Cash and Cash Equivalents ......................................... $10,320 $ 5,421

Short-Term Investments ........................................... 620 590

Accounts Receivable, net of allowances of $120 and $108 ................ 1,323 1,207

Assets Under Management ......................................... 1,970 1,825

Deferred Income Taxes ............................................ 561 650

Other Current Assets .............................................. 1,250 854

Total Current Assets .......................................... 16,044 10,547

Long-Term Investments ................................................ 9,642 8,971

Property, Equipment, and Capitalized Software, net of accumulated depreciation

and amortization of $1,215 and $966 ................................... 1,894 1,647

Goodwill ........................................................... 16,822 16,238

Other Intangible Assets, net of accumulated amortization of $373 and $192 ....... 1,904 2,020

Other Assets ......................................................... 2,014 1,865

Total Assets ................................................. $48,320 $41,288

Liabilities and Shareholders’ Equity

Current Liabilities

Medical Costs Payable ............................................. $ 8,076 $ 7,262

Accounts Payable and Accrued Liabilities ............................. 3,713 3,285

Other Policy Liabilities ............................................ 3,957 1,845

Commercial Paper and Current Maturities of Long-Term Debt ............. 1,483 3,261

Unearned Premiums ............................................... 1,268 1,000

Total Current Liabilities ........................................ 18,497 16,653

Long-Term Debt, less current maturities ................................... 5,973 3,834

Future Policy Benefits for Life and Annuity Contracts ........................ 1,850 1,761

Deferred Income Taxes and Other Liabilities ............................... 1,190 1,225

Commitments and Contingencies (Note 14) ................................

Shareholders’ Equity

Common Stock, $0.01 par value — 3,000 shares authorized; 1,345 and 1,358

shares outstanding .............................................. 13 14

Additional Paid-In Capital .......................................... 6,406 7,510

Retained Earnings ................................................ 14,376 10,258

Accumulated Other Comprehensive Income:

Net Unrealized Gains on Investments, net of tax effects ............... 15 33

Total Shareholders’ Equity ..................................... 20,810 17,815

Total Liabilities and Shareholders’ Equity ....................... $48,320 $41,288

See Notes to Consolidated Financial Statements.

65