United Healthcare 2006 Annual Report Download - page 118

Download and view the complete annual report

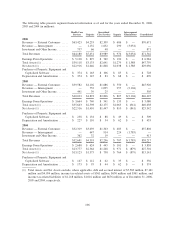

Please find page 118 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock Incentive Plan, as amended, which was not approved by the company’s shareholders, but the shares

issuable under the 1998 Broad-Based Stock Incentive Plan were subsequently included in the number of

shares approved by the Company’s shareholders when approving the 2002 Stock Incentive Plan.

(2) Excludes 8,154,346 shares underlying stock options assumed by us in connection with our acquisition of the

companies under whose plans the options originally were granted. These options have a weighted-average

exercise price of $17.86 and an average remaining term of approximately 4.80 years. The options are

administered pursuant to the terms of the plan under which the option originally was granted. No future

options or other awards will be granted under these acquired plans.

(3) Includes 3,944,915 shares of common stock available for future issuance under the Employee Stock

Purchase Plan as of December 31, 2006, and 82,999,831 shares available under the 2002 Stock Incentive

Plan as of December 31, 2006. Shares available under the 2002 Stock Incentive Plan may become the

subject of future awards in the form of stock options, stock appreciation rights, restricted stock, restricted

stock units, performance awards and other stock-based awards, except that only 26,165,516 of these shares

are available for future grants of awards other than stock options or stock appreciation rights.

The information required by Item 403 of Regulation S-K will be included under the heading “Security

Ownership of Certain Beneficial Owners and Management” in our definitive proxy statement for our Annual

Meeting of Shareholders to be held May 29, 2007, and such required information is incorporated herein by

reference.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

The information required by Items 404 and 407(a) of Regulation S-K will be included under the headings

“Certain Relationships and Transactions” and “Corporate Governance” in our definitive proxy statement for the

Annual Meeting of Shareholders to be held May 29, 2007, and such required information is incorporated herein

by reference.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

The information required by Item 9(e) of Schedule 14A will be included under the heading “Independent

Registered Public Accounting Firm” in our definitive proxy statement for the Annual Meeting of Shareholders to

be held May 29, 2007, and such required information is incorporated herein by reference.

116