United Healthcare 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

by unfavorable changes in the credit ratings associated with these securities. We evaluate impairment at each

reporting period for each of the securities where the fair value of the investment is less than its cost. The

contractual cash flows of the U.S. Government and Agency obligations are either guaranteed by the U.S.

Government or an agency of the U.S. Government. It is expected that the securities would not be settled at a price

less than the cost of our investment. We evaluated the credit ratings of the state and municipal obligations and the

corporate obligations, noting neither a significant deterioration since purchase nor other factors leading to other-

than-temporary impairment.

A portion of the Company’s investments in equity securities consists of investments held by our UnitedHealth

Capital business in various public and nonpublic companies concentrated in the areas of health care delivery and

related information technologies. Market conditions that affect the value of health care and related technology

stocks will likewise impact the value of our equity portfolio. The equity securities were evaluated for severity

and duration of unrealized loss, overall market volatility and other market factors.

We analyze relevant factors individually and in combination including the length of time and extent to which

market value has been less than cost, the financial condition and near-term prospects of the issuer as well as

specific events or circumstances that may influence the operations of the issuer, and our intent and ability to hold

the investment for a sufficient time to recover our cost. We revise impairment judgments when new information

becomes known or when we do not anticipate holding the investment until recovery. If any of our investments

experience a decline in fair value that is determined to be other-than-temporary, based on analysis of relevant

factors, we record a realized loss in our Consolidated Statements of Operations. We do not consider the

unrealized losses on each of the investments described above to be other-than-temporarily impaired at

December 31, 2006.

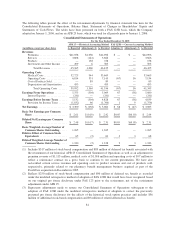

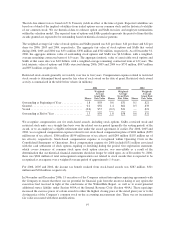

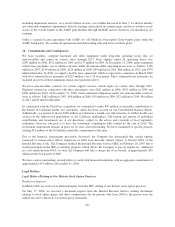

We recorded realized gains and losses on sales of investments, as follows:

For the Year Ended

December 31,

(in millions) 2006 2005 2004

Gross Realized Gains ........................................................ $41 $60 $62

Gross Realized Losses ........................................................ (37) (50) (18)

Net Realized Gains ...................................................... $ 4 $10 $44

Included in the realized losses above are impairment charges of $4 million, $8 million and $8 million for 2006,

2005 and 2004, respectively.

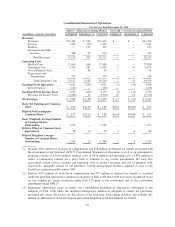

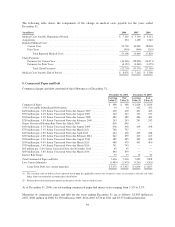

7. Goodwill and Other Intangible Assets

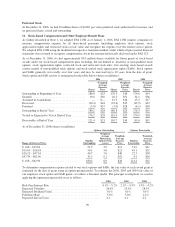

Changes in the carrying amount of goodwill, by segment, during the years ended December 31, 2006 and 2005

(as restated), were as follows:

(in millions)

Health

Care

Services Uniprise

Specialized

Care Services Ingenix Consolidated

Balance at December 31, 2004 .................... $ 7,505 $903 $ 406 $665 $ 9,479

Acquisitions and Subsequent Payments/Adjustments . . 6,359 14 326 60 6,759

Balance at December 31, 2005 .................... 13,864 917 732 725 16,238

Acquisitions and Subsequent Payments/Adjustments . . 132 29 322 101 584

Balance at December 31, 2006 .................... $13,996 $946 $1,054 $826 $16,822

91