Under Armour 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

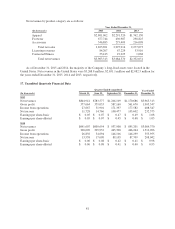

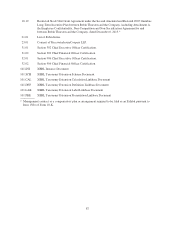

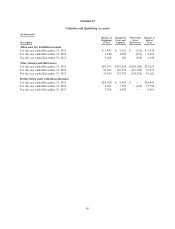

Schedule II

Valuation and Qualifying Accounts

(In thousands)

Description

Balance at

Beginning

of Year

Charged to

Costs and

Expenses

Write-Offs

Net of

Recoveries

Balance at

End of

Year

Allowance for doubtful accounts

For the year ended December 31, 2015 $ 3,693 $ 2,951 $ (714) $ 5,930

For the year ended December 31, 2014 2,938 1,028 (273) 3,693

For the year ended December 31, 2013 3,286 210 (558) 2,938

Sales returns and allowances

For the year ended December 31, 2015 $52,973 $145,828 $(126,186) $72,615

For the year ended December 31, 2014 34,102 156,791 (137,920) 52,973

For the year ended December 31, 2013 32,919 135,739 (134,556) 34,102

Deferred tax asset valuation allowance

For the year ended December 31, 2015 $15,550 $ 8,493 $ — $24,043

For the year ended December 31, 2014 8,091 7,581 (122) 15,550

For the year ended December 31, 2013 3,996 4,095 — 8,091

89