Under Armour 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

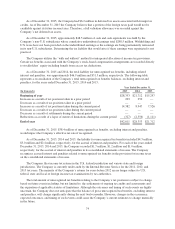

In December 2012, the Company entered into a $50.0 million recourse loan collateralized by the land,

buildings and tenant improvements comprising the Company’s corporate headquarters. The loan has a seven year

term and maturity date of December 2019. The loan bears interest at one month LIBOR plus a margin of 1.50%,

and allows for prepayment without penalty. The loan includes covenants and events of default substantially

consistent with the new credit agreement discussed above. The loan also requires prior approval of the lender for

certain matters related to the property, including transfers of any interest in the property. As of December 31,

2015, 2014 and 2013, the outstanding balance on the loan was $44.0 million, $46.0 million and $48.0 million,

respectively. The weighted average interest rate on the loan was 1.7% for the years ended December 31, 2015,

2014 and 2013.

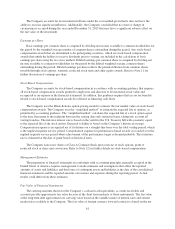

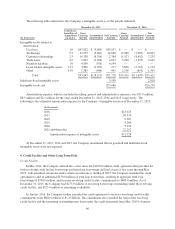

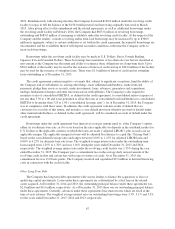

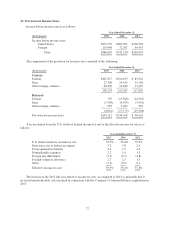

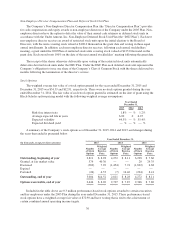

The following are the scheduled maturities of long term debt as of December 31, 2015:

(In thousands)

2016 $ 42,000

2017 42,000

2018 42,000

2019 543,000

2020 —

2021 and thereafter —

Total scheduled maturities of long term debt 669,000

Less current maturities of long term debt 42,000

Long term debt obligations $627,000

Interest expense, net was $14.6 million, $5.3 million and $2.9 million for the years ended December 31,

2015, 2014 and 2013, respectively. Interest expense includes the amortization of deferred financing costs and

interest expense under the credit and long term debt facilities.

The Company monitors the financial health and stability of its lenders under the credit and other long term

debt facilities, however during any period of significant instability in the credit markets lenders could be

negatively impacted in their ability to perform under these facilities.

7. Commitments and Contingencies

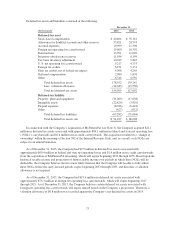

Obligations Under Operating Leases

The Company leases warehouse space, office facilities, space for its brand and factory house stores and

certain equipment under non-cancelable operating leases. The leases expire at various dates through 2031,

excluding extensions at the Company’s option, and include provisions for rental adjustments. The table below

includes executed lease agreements for brand and factory house stores that the Company did not yet occupy as of

December 31, 2015 and does not include contingent rent the Company may incur at its stores based on future

sales above a specified minimum or payments made for maintenance, insurance and real estate taxes. The

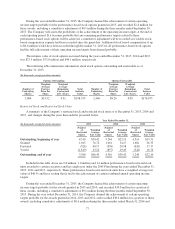

following is a schedule of future minimum lease payments for non-cancelable real property operating leases as of

December 31, 2015 as well as significant operating lease agreements entered into during the period after

December 31, 2015 through the date of this report:

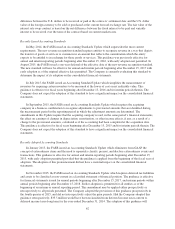

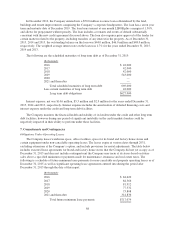

(In thousands)

2016 $ 84,620

2017 84,566

2018 81,912

2019 77,332

2020 73,808

2021 and thereafter 314,836

Total future minimum lease payments $717,074

68