Under Armour 2015 Annual Report Download - page 52

Download and view the complete annual report

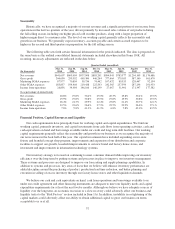

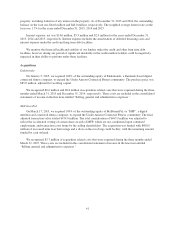

Please find page 52 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Allowance for Doubtful Accounts

We make ongoing estimates relating to the collectability of accounts receivable and maintain an allowance

for estimated losses resulting from the inability of our customers to make required payments. In determining the

amount of the reserve, we consider historical levels of credit losses and significant economic developments

within the retail environment that could impact the ability of our customers to pay outstanding balances and

make judgments about the creditworthiness of significant customers based on ongoing credit evaluations.

Because we cannot predict future changes in the financial stability of our customers, actual future losses from

uncollectible accounts may differ from estimates. If the financial condition of customers were to deteriorate,

resulting in their inability to make payments, a larger reserve might be required. In the event we determine a

smaller or larger reserve is appropriate, we would record a benefit or charge to selling, general and administrative

expense in the period in which such a determination was made. As of December 31, 2015 and 2014, the

allowance for doubtful accounts was $5.9 million and $3.7 million, respectively.

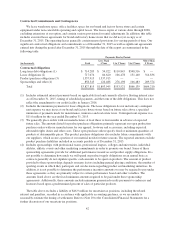

Subsequent to December 31, 2015, we became aware of the deteriorating financial condition of one of our

wholesale customers, The Sports Authority. Our recorded reserve as of year-end materially reflects our best

estimate, based on currently available information, of the ultimate recoverability of amounts due from this

customer at December 31, 2015. As of December 31, 2015, the amount of this receivable totaled $32.5 million.

However, we do not currently believe that the exposure to our receivables as of December 31, 2015 is materially

impacted by the developments related to The Sports Authority. If the financial condition of this customer

continues to deteriorate, this could result in us recording additional reserves against our receivables balance. See

“Risk Factors—If the financial condition of our customers declines, our financial condition and results of

operations could be adversely impacted.”

Inventory Valuation and Reserves

We value our inventory using the first-in, first-out method of cost determination. Market value is estimated

based upon assumptions made about future demand and retail market conditions. If we determine that the

estimated market value of our inventory is less than the carrying value of such inventory, we record a charge to

cost of goods sold to reflect the lower of cost or market. If actual market conditions are less favorable than those

we projected, further adjustments may be required that would increase the cost of goods sold in the period in

which such a determination was made.

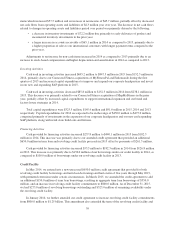

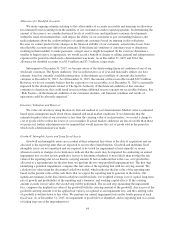

Goodwill, Intangible Assets and Long-Lived Assets

Goodwill and intangible assets are recorded at their estimated fair values at the date of acquisition and are

allocated to the reporting units that are expected to receive the related benefits. Goodwill and indefinite lived

intangible assets are not amortized and are required to be tested for impairment at least annually or sooner

whenever events or changes in circumstances indicate that the assets may be impaired. In conducting an annual

impairment test, we first review qualitative factors to determine whether it is more likely than not that the fair

value of the reporting unit is less than its carrying amount. If factors indicate that is the case, or if goodwill is

allocated to a reporting unit for the first time, we perform the two-step goodwill impairment test. The first step,

identifying a potential impairment, compares the fair value of the reporting unit with its carrying amount. We

calculate fair value using the discounted cash flows model, which indicates the fair value of the reporting unit

based on the present value of the cash flows that we expect the reporting unit to generate in the future. Our

significant estimates in the discounted cash flows model include: our weighted average cost of capital, long-term

rate of growth and profitability of the reporting unit’s business, and working capital effects. If the carrying

amount exceeds its fair value, the second step will be performed. The second step, measuring the impairment

loss, compares the implied fair value of the goodwill with the carrying amount of the goodwill. Any excess of the

goodwill carrying amount over the applied fair value is recognized as an impairment loss, and the carrying value

of goodwill is written down to fair value. We perform our annual impairment tests in the fourth quarter of each

fiscal year. As of December 31, 2015, no impairment of goodwill was identified, and no reporting unit was at risk

of failing step one of the impairment test.

44