Under Armour 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

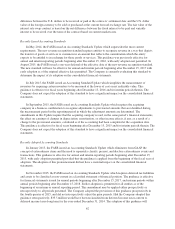

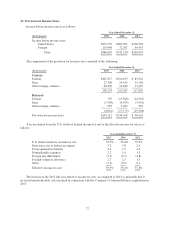

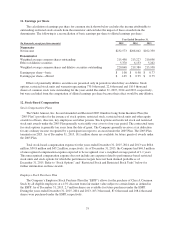

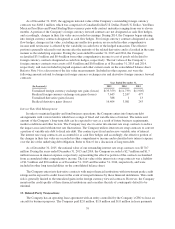

10. Provision for Income Taxes

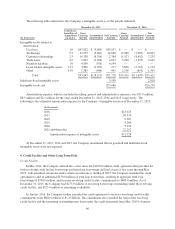

Income before income taxes is as follows:

Year Ended December 31,

(In thousands) 2015 2014 2013

Income before income taxes:

United States $272,739 $269,503 $196,558

Foreign 113,946 72,707 64,435

Total $386,685 $342,210 $260,993

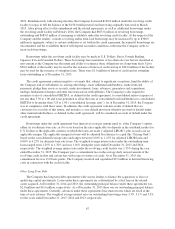

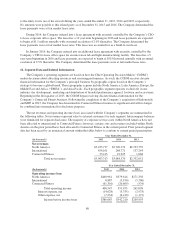

The components of the provision for income taxes consisted of the following:

Year Ended December 31,

(In thousands) 2015 2014 2013

Current

Federal $102,317 $110,439 $ 85,542

State 27,500 24,419 19,130

Other foreign countries 28,336 16,489 13,295

158,153 151,347 117,967

Deferred

Federal 707 (15,368) (14,722)

State (5,703) (4,073) (5,541)

Other foreign countries 955 2,262 959

(4,041) (17,179) (19,304)

Provision for income taxes $154,112 $134,168 $ 98,663

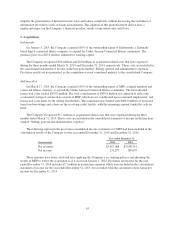

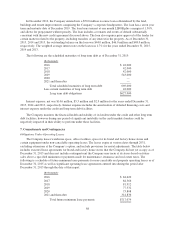

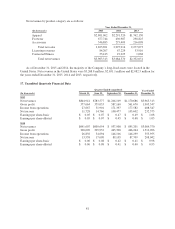

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate is as

follows:

Year Ended December 31,

2015 2014 2013

U.S. federal statutory income tax rate 35.0% 35.0% 35.0%

State taxes, net of federal tax impact 3.2 3.8 2.4

Unrecognized tax benefits 3.4 1.9 2.5

Nondeductible expenses 2.2 1.0 1.1

Foreign rate differential (5.5) (4.5) (4.8)

Foreign valuation allowance 2.7 2.5 1.5

Other (1.1) (0.5) 0.1

Effective income tax rate 39.9% 39.2% 37.8%

The increase in the 2015 full year effective income tax rate, as compared to 2014, is primarily due to

increased non-deductible costs incurred in connection with the Company’s Connected Fitness acquisitions in

2015.

72