Under Armour 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.property, including transfers of any interest in the property. As of December 31, 2015 and 2014, the outstanding

balance on the loan was $44.0 million and $46.0 million, respectively. The weighted average interest rate on the

loan was 1.7% for the years ended December 31, 2015, 2014 and 2013.

Interest expense, net was $14.6 million, $5.3 million and $2.9 million for the years ended December 31,

2015, 2014 and 2013, respectively. Interest expense includes the amortization of deferred financing costs and

interest expense under the credit and long term debt facilities.

We monitor the financial health and stability of our lenders under the credit and other long term debt

facilities, however during any period of significant instability in the credit markets lenders could be negatively

impacted in their ability to perform under these facilities.

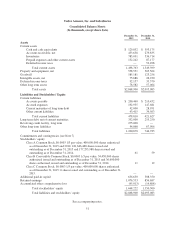

Acquisitions

Endomondo

On January 5, 2015, we acquired 100% of the outstanding equity of Endomondo, a Denmark-based digital

connected fitness company, to expand the Under Armour Connected Fitness community. The purchase price was

$85.0 million, adjusted for working capital.

We recognized $0.6 million and $0.8 million in acquisition related costs that were expensed during the three

months ended March 31, 2015 and December 31, 2014, respectively. These costs are included in the consolidated

statements of income in the line item entitled “Selling, general and administrative expenses.”

MyFitnessPal

On March 17, 2015, we acquired 100% of the outstanding equity of MyFitnessPal, or “MFP”, a digital

nutrition and connected fitness company, to expand the Under Armour Connected Fitness community. The final

adjusted transaction value totaled $474.0 million. The total consideration of $463.9 million was adjusted to

reflect the accelerated vesting of certain share awards of MFP, which are not conditioned upon continued

employment, and transaction costs borne by the selling shareholders. The acquisition was funded with $400.0

million of increased term loan borrowings and a draw on the revolving credit facility, with the remaining amount

funded by cash on hand.

We recognized $5.7 million of acquisition related costs that were expensed during the three months ended

March 31, 2015. These costs are included in the consolidated statement of income in the line item entitled

“Selling, general and administrative expenses.”

41