Under Armour 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

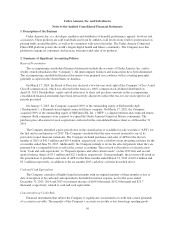

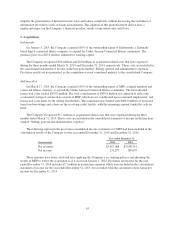

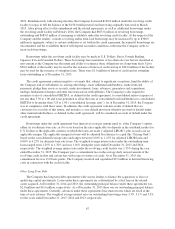

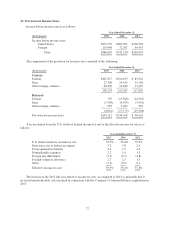

These acquisitions have been accounted for as business combinations under the acquisition method and,

accordingly, the total purchase price is allocated to the tangible and intangible assets acquired and the liabilities

assumed based on their respective fair values on the acquisition dates, with the remaining unallocated purchase

price recorded as goodwill. These purchase price allocations are final. The following table summarizes the

allocation of estimated fair values of the net assets acquired, including the related estimated useful lives, where

applicable:

MyFitnessPal Endomondo

(in thousands)

Useful life

(in years) (in thousands)

Useful life

(in years)

Finite-lived intangible assets:

User base $ 38,300 10 $10,600 10

Nutrition database 4,500 10 — N/A

Technology 3,200 5 5,000 5

Trade name 2,300 5 400 5

Other assets acquired 16,190 3,738

Liabilities assumed (3,291) (2,784)

Net assets acquired 61,199 16,954

Goodwill 402,728 70,290

Total fair value of consideration $463,927 $87,244

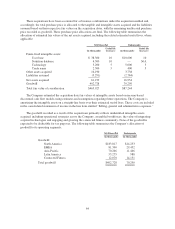

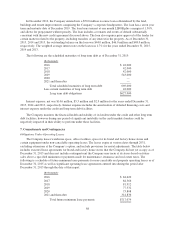

The Company estimated the acquisition date fair values of intangible assets based on income-based

discounted cash flow models using estimates and assumptions regarding future operations. The Company is

amortizing the intangible assets on a straight-line basis over their estimated useful lives. These costs are included

in the consolidated statements of income in the line item entitled “Selling, general and administrative expenses.”

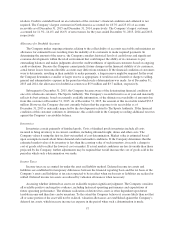

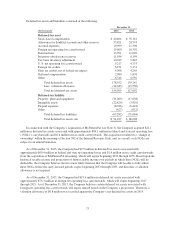

The goodwill recorded as a result of the acquisitions primarily reflects unidentified intangible assets

acquired, including operational synergies across the Company, assembled workforces, the value of integrating

acquired technologies and engaging and growing the connected fitness community. None of the goodwill is

expected to be deductible for tax purposes. The following table summarizes the Company’s allocation of

goodwill to its operating segments:

MyFitnessPal Endomondo

(in thousands) (in thousands)

Goodwill:

North America $183,817 $14,253

EMEA 81,300 29,452

Asia-Pacific 70,266 11,446

Latin America 55,275 988

Connected Fitness 12,070 14,151

Total goodwill $402,728 70,290

64