Under Armour 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

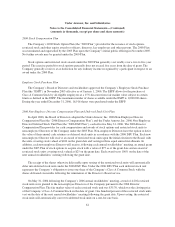

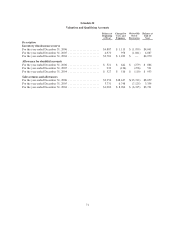

Restricted Stock

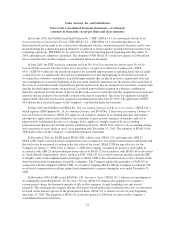

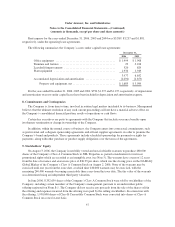

A summary of the Company’s restricted stock as of December 31, 2006, 2005, and 2004, and changes

during the years then ended is presented below:

Year Ended December 31,

2006 2005 2004

Number of

Restricted

Shares

Weighted

Average

Price

Number of

Restricted

Shares

Weighted

Average

Price

Number of

Restricted

Shares

Weighted

Average

Price

Outstanding, beginning of year .......... 125,200 $ 7.79 — $ — — $—

Granted .............................. 105,900 39.46 140,100 7.87 — —

Forfeited ............................. (7,400) 17.93 (900) 8.50 — —

Vested ............................... (17,450) 9.16 (14,000) 8.51 — —

Outstanding, end of year ............... 206,250 $23.57 125,200 $7.79 — $—

In addition to the 206,250 shares of restricted stock shown above as of December 31, 2006, there were an

additional 131,070 shares of restricted stock outstanding that were purchased by members of the Board of

Directors. These shares of restricted stock vest through September 2007.

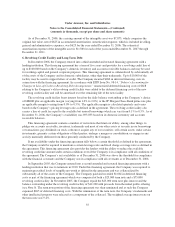

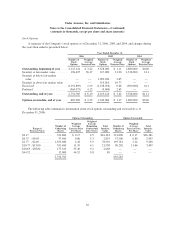

13. Other Employee Benefits

The Company offers a 401(k) Deferred Compensation plan for the benefit of eligible employees. Employee

contributions are voluntary and subject to Internal Revenue Service limitations. The Company matches a portion

of the participant’s contribution and recorded expense for the years ended December 31, 2006, 2005 and 2004, of

$690, $382 and $130, respectively. Shares of the Company’s Class A Common Stock are not an investment

option in this plan.

In November 2005, the Company’s Board of Directors and stockholders approved a Deferred Compensation

Plan. This plan allows a select group of management or highly compensated employees as approved by the

Compensation Committee, to make an annual base salary and/or bonus deferral for that specific year. The

employee shall be vested in all amounts credited to his or her account, as of the date such amounts are credited to

such employee’s account. This plan has not yet been implemented by the Company. As a result, at December 31,

2006 and 2005 no amounts are included on the balance sheet relating to this plan.

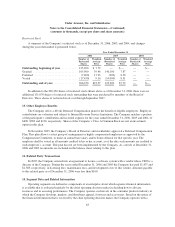

14. Related Party Transactions

In 2005, the Company entered into an agreement to license a software system with a vendor whose CEO is a

director of the Company. During the years ended December 31, 2006 and 2005 the Company has paid $1,437 and

$1,383, respectively, in licensing fees, maintenance fees, and development costs to this vendor. Amounts payable

to this related party as of December 31, 2006 were less than $100.

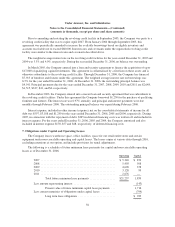

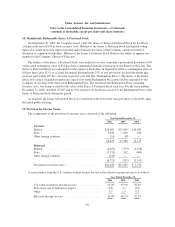

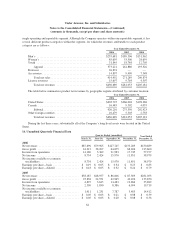

15. Segment Data and Related Information

Operating segments are defined as components of an enterprise about which separate financial information

is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate

resources and in assessing performance. The Company operates exclusively in the consumer products industry in

which the Company develops, markets, and distributes apparel, footwear and accessories. Based on the nature of

the financial information that is received by the chief operating decision maker, the Company operates with a

63