Under Armour 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

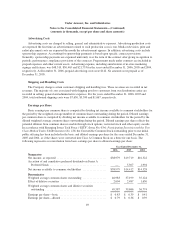

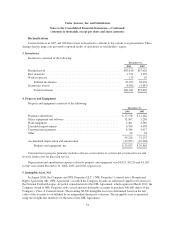

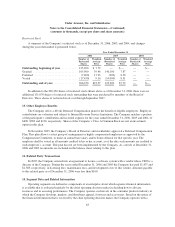

As of December 31, 2006, the carrying amount of the intangible asset was $7,875, which comprises the

original fair value, net of $625 in accumulated amortization. Amortization expense, which is included in selling,

general and administrative expenses, was $625 for the year ended December 31, 2006. The estimated

amortization expense of the intangible asset is $1,500 for each of the years ended December 31, 2007 through

December 31, 2011.

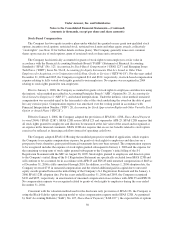

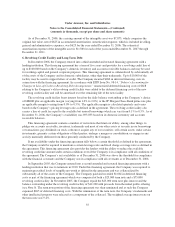

6. Revolving Credit Facility and Long Term Debt

In December 2006, the Company entered into a third amended and restated financing agreement with a

lending institution. This financing agreement has a term of five years and provides for a revolving credit line of

up to $100,000 based on the Company’s domestic inventory and accounts receivable balances and may be used

for working capital and general corporate purposes. This financing agreement is collateralized by substantially all

of the assets of the Company and its domestic subsidiaries, other than their trademarks. Up to $10,000 of the

facility may be used to support letters of credit. The Company incurred $260 in deferred financing costs in

connection with the financing agreement. In accordance with EITF Issue No. 98-14, “Debtor’s Accounting for

Changes in Line-of-Credit or Revolving-Debt Arrangements,” unamortized deferred financing costs of $618

relating to the Company’s old revolving credit facility were added to the deferred financing costs of the new

revolving credit facility and will be amortized over the remaining life of the new facility.

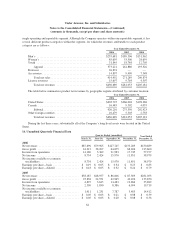

The revolving credit facility bears interest based on the daily balance outstanding at the Company’s choice

of LIBOR plus an applicable margin (varying from 1.0% to 2.0%) or the JP Morgan Chase Bank prime rate plus

an applicable margin (varying from 0.0% to 0.5%). The applicable margin is calculated quarterly and varies

based on the Company’s pricing leverage ratio as defined in the agreement. The revolving credit facility also

carries a line of credit fee equal to the available but unused borrowings which can vary from 0.1% to 0.5%. As of

December 31, 2006, the Company’s availability was $93,033 based on its domestic inventory and accounts

receivable balances.

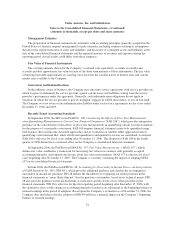

This financing agreement contains a number of restrictions that limit our ability, among other things, to

pledge our accounts receivable, inventory, trademarks and most of our other assets as security in our borrowings

or transactions; pay dividends on stock; redeem or acquire any of our securities; sell certain assets; make certain

investments; guaranty certain obligations of third parties; undergo a merger or consolidation; or engage in any

activity materially different from those presently conducted by the Company.

If net availability under the financing agreement falls below a certain threshold as defined in the agreement,

the Company would be required to maintain a certain leverage ratio and fixed charge coverage ratio as defined in

the agreement. This financing agreement also provides the lenders with the ability to reduce the available

revolving credit line amount under certain conditions even if the Company is in compliance with all conditions of

the agreement. The Company’s net availability as of December 31, 2006 was above the threshold for compliance

with the financial covenants and the Company was in compliance with all covenants as of December 31, 2006.

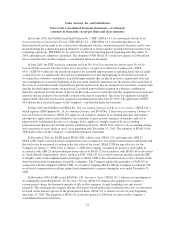

In September 2005, the Company entered into a second amended and restated financing agreement with a

lending institution that was to terminate in 2010. Under this financing agreement, the Company was required to

maintain prescribed levels of tangible net worth as defined in the agreement and was collateralized by

substantially all of the assets of the Company. The Company paid and recorded $1,061 in deferred financing

costs as part of the financing agreement which was comprised of both a $25,000 term note and a $75,000

revolving credit facility. In November 2005, the Company repaid the $25,000 term note plus interest and the

balance outstanding under the revolving credit facility of $12,200 with proceeds from the initial public offering

(see Note 9). The term note portion of the financing agreement was then terminated and as such the Company

expensed $265 of deferred financing costs. With the termination of the term note, the Company’s trademarks and

other intellectual property were released as a component of the collateral. The weighted average interest rate on

the term note was 9.4%.

55