Under Armour 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

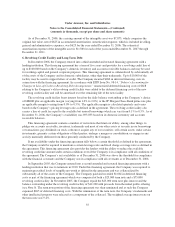

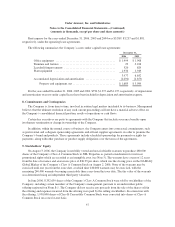

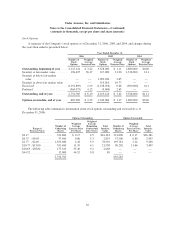

In November 2005, the Company completed an initial public offering and issued an additional 9,500,000

shares of common stock. As part of the initial public offering, 1,208,055 outstanding shares of Convertible

Common Stock held by Rosewood entities were converted to Class A Common Stock on a three-for-one basis.

The Company received proceeds of $112,676 net of $10,824 in stock issue costs, which it used to repay the

$25,000 term note, the balance outstanding under the revolving credit facility of $12,200, and the Series A

Preferred Stock of $12,000.

As part of a recapitalization in connection with the initial public offering, the Company’s stockholders

approved an amended and restated charter that provides for the issuance of up to 100,000,000 shares of common

stock, par value $0.0003 1/3 per share, and permits amendments to the charter without stockholder approval to

increase or decrease the aggregate number of shares of stock authorized, or the number of shares of stock of any

class or series of stock authorized, and to classify or reclassify unissued shares of stock.

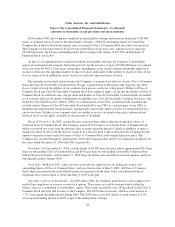

The amended and restated charter divides the Company’s common stock into two classes, Class A Common

Stock and Class B Convertible Common Stock. Except as provided for in the future with respect to any other

class or series of stock, the holders of our common stock possess exclusive voting power. Holders of Class A

Common Stock and Class B Convertible Common Stock have identical rights, except that the holders of Class A

Common Stock are entitled to one vote per share and holders of Class B Convertible Common Stock are entitled

to 10 votes per share on all matters submitted to stockholder vote. Class B Convertible Common Stock may only

be held by our Chief Executive Officer (CEO), or a related party of our CEO, as defined in the amended and

restated charter. Shares of Class B Convertible Stock not held by our CEO, or a related party of our CEO, as

defined in the amended and restated charter, automatically convert into shares of Class A Common Stock on a

one-to-one basis. Holders of our common stock are entitled to receive dividends when and if authorized and

declared out of assets legally available for the payment of dividends.

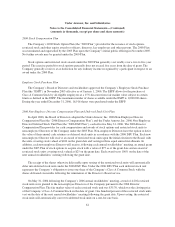

Board of Directors—In 2005, certain directors exercised their right as directors to purchase shares of

restricted Class A Common Stock. The Company issued 131,070 shares of restricted Class A Common Stock

which vest in full two years from the purchase date or sooner upon the director’s death or disability or upon a

change in control. In the event the director ceases to be a director prior to the vesting date the Company has the

option to repurchase these restricted shares of Class A Common Stock at the original purchase price. The

Company has recorded unearned compensation of $99 and recognized $49 and $37 in compensation expense for

the years ended December 31, 2006 and 2005, respectively.

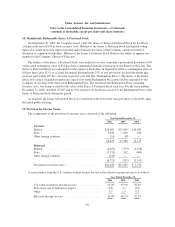

Dividends—On December 31, 2004, cash dividends of $5,000 were declared, which approximated $0.14 per

share on outstanding Class A Common Stock and $0.42 per share on outstanding Convertible Common Stock

held by Rosewood entities. At December 31, 2004, these dividends were included in accrued expenses and were

subsequently paid in January 2005.

Stock Split—In March 2005, a three for one stock split was approved for all authorized, issued, and

outstanding shares of Class A Common Stock, with an effective date of May 3, 2005. All Class A Common

Stock shares presented in the consolidated financial statements and the notes to the consolidated financial

statements have been restated to reflect the May 3, 2005 stock split.

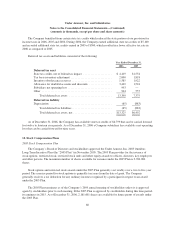

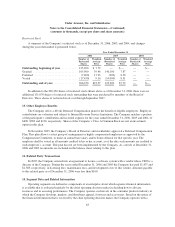

Notes Receivable from Stockholder—In 2005 and in 2000, the Company made loans to select employees to

enable these employees to exercise vested stock options. These notes receivable were presented within the

balance sheet as a component of stockholders’ equity. These notes receivable were collateralized by the Class A

Common Stock and were full recourse to the Company. The 2005 notes receivable, which accrued interest at

7.7%, were repaid including interest during 2006. The 2000 notes receivable, which accrued interest at 5.5%,

were repaid including interest in 2005 as part of the initial public offering.

58