Under Armour 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

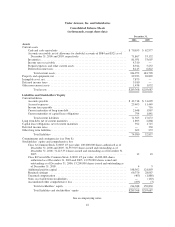

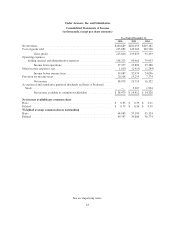

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements

(amounts in thousands, except per share and share amounts)

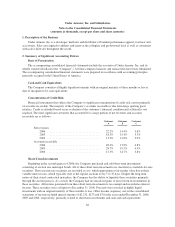

1. Description of the Business

Under Armour, Inc. is a developer, marketer and distributor of branded performance apparel, footwear and

accessories. Sales are targeted to athletes and teams at the collegiate and professional level as well as consumers

with active lifestyles throughout the world.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements include the accounts of Under Armour, Inc. and its

wholly owned subsidiaries (the “Company”). All inter-company balances and transactions have been eliminated.

The accompanying consolidated financial statements were prepared in accordance with accounting principles

generally accepted in the United States of America.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less at

date of inception to be cash equivalents.

Concentration of Credit Risk

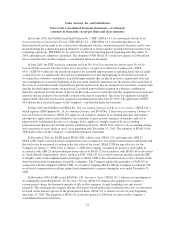

Financial instruments that subject the Company to significant concentration of credit risk consist primarily

of accounts receivable. The majority of the Company’s accounts receivable is due from large sporting good

retailers. Credit is extended based on an evaluation of the customer’s financial condition and collateral is not

required. The most significant customers that accounted for a large portion of net revenues and accounts

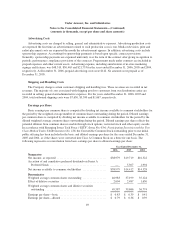

receivable are as follows:

Customer

A

Customer

B

Customer

C

Net revenues

2006 ..................................... 22.2% 14.4% 3.6%

2005 ..................................... 18.5% 15.4% 3.3%

2004 ..................................... 13.3% 12.8% 2.9%

Accounts receivable

2006 ..................................... 28.4% 15.8% 4.8%

2005 ..................................... 28.7% 19.5% 4.5%

2004 ..................................... 15.5% 14.7% 3.8%

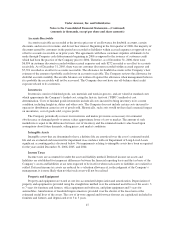

Short-Term Investments

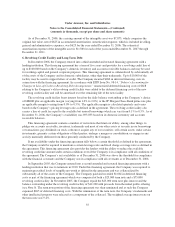

Beginning in the second quarter of 2006, the Company purchased and sold short-term investments

consisting of auction rate municipal bonds. All of these short-term investments are classified as available-for-sale

securities. These auction rate securities are recorded at cost, which approximates fair market value due to their

variable interest rates, which typically reset at the regular auctions every 7 to 35 days. Despite the long-term

nature of their stated contractual maturities, the Company has the ability to liquidate these securities primarily

through the auction process. As a result, the Company had no unrealized gains or losses from its investments in

these securities. All income generated from these short-term investments is tax exempt and recorded as interest

income. These securities were sold prior to December 31, 2006. Proceeds were invested in highly liquid

investments with an original maturity of three months or less. Other income (expense), net on the consolidated

statements of income included interest income of $2,231, $273 and $7 for the years ended December 31, 2006,

2005 and 2004, respectively, primarily related to short-term investments and cash and cash equivalents.

46