Under Armour 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

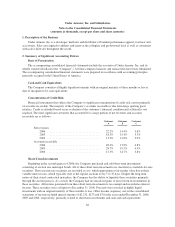

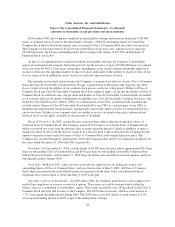

In October 2005, the FASB issued Staff Position No. (“FSP”) SFAS 13-1, Accounting for Rental Costs

Incurred during a Construction Period (“FSP SFAS 13-1”). FSP SFAS 13-1 concludes that there is no

distinction between the right to use a leased asset during and after the construction period; therefore rental costs

incurred during the construction period should be recognized as rental expense and deducted from income from

continuing operations. FSP SFAS 13-1 is effective for the first reporting period beginning after December 15,

2005, although early adoption is permitted. The adoption of FSP SFAS 13-1 in the first quarter of 2006 did not

have a material effect on the Company’s consolidated financial statements.

In June 2005, the EITF reached a consensus on Issue No. 05-6, Determining the Amortization Period for

Leasehold Improvements Purchased after Lease Inception or Acquired in a Business Combination (“EITF

05-6”). EITF 05-6 addresses the amortization period for leasehold improvements in operating leases that are either

(a) placed in service significantly after and not contemplated at or near the beginning of the initial lease term or

(b) acquired in a business combination. Leasehold improvements that are placed in service significantly after and

not contemplated at or near the beginning of the lease term should be amortized over the shorter of the useful life of

the assets or a term that includes required lease periods and renewals that are deemed to be reasonably assured at the

date the leasehold improvements are purchased. Leasehold improvements acquired in a business combination

should be amortized over the shorter of the useful life of the assets or a term that includes required lease periods and

renewals that are deemed to be reasonably assured at the date of acquisition. This Issue was applied to leasehold

improvements that were purchased or acquired in reporting periods after June 29, 2005. The application of EITF

05-6 did not have a material impact on the Company’s consolidated financial statements.

In May 2005, the FASB issued SFAS No. 154, Accounting Changes and Error Corrections, (“SFAS 154”)

which replaces APB Opinion No. 20, Accounting Changes, and SFAS No. 3, Reporting Accounting Changes in

Interim Financial Statements. SFAS 154 applies to all voluntary changes in accounting principle and requires

retrospective application (a term defined by the statement) to prior periods’ financial statements, unless it is

impracticable to determine the effect of a change. It also applies to changes required by an accounting

pronouncement that does not include specific transition provisions. SFAS 154 is effective for accounting changes

and corrections of errors made in fiscal years beginning after December 15, 2005. The adoption of SFAS 154 in

2006 had no effect on the Company’s consolidated financial statements.

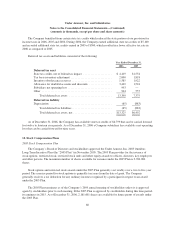

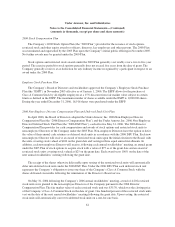

In December 2004, the FASB issued SFAS 123R, which revises SFAS 123, and supersedes APB 25.

SFAS 123R requires all stock-based compensation to be recognized as an expense in the financial statements and

that such costs be measured according to the fair value of the award. SFAS 123R became effective for the

Company on January 1, 2006. Prior to January 1, 2006, the Company accounted for grants of stock rights in

accordance with APB 25 and provided pro forma effects of SFAS 123 in accordance with SFAS 148 as discussed

in “Stock-Based Compensation” above. In March 2005, SAB 107 was issued to provide guidance from the SEC

to simplify some of the implementation challenges of SFAS 123R as this statement relates to the valuation of the

share-based payment arrangements for public companies. The Company applied the principles of SAB 107 in

connection with the adoption of SFAS 123R. As a result of adopting SFAS 123R the Company recorded $1,536

stock-based compensation in selling, general and administrative expenses during the year ended December 31,

2006.

In November 2004, FASB issued SFAS No. 151, Inventory Costs (“SFAS 151”) which is an amendment of

Accounting Research Bulletin No. 43, Inventory Pricing. SFAS 151 requires all companies to recognize a

current-period charge for abnormal amounts of idle facility expenses, freight, handling costs and wasted

materials. This statement also requires that the allocation of fixed production overhead to the costs of conversion

be based on the normal capacity of the production facilities. SFAS 151 is effective for fiscal years beginning

after June 15, 2005. The adoption of SFAS 151 in the first quarter of 2006 had no effect on the Company’s

consolidated financial statements.

53