Under Armour 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

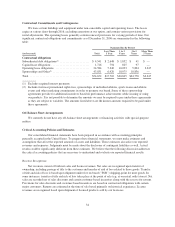

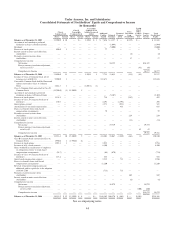

Under Armour, Inc. and Subsidiaries

Consolidated Statements of Stockholders’ Equity and Comprehensive Income

(in thousands)

Class A

Common Stock

Class B

Convertible

Common Stock

Convertible

Common Stock

held by Rosewood

entities Additional

Paid-In

Capital

Retained

Earnings

Unearned

Compen-

sation

Notes

Receivable

from

Stockholders

Accum

ulated

Other

Compre-

hensive

Loss

Compre-

hensive

Income

Total

Stockholders’

EquityShares Amount Shares Amount Shares Amount

Balance as of December 31, 2003 .......... 31,200.0 $ 10 — $— 1,208.1 $ 1 $ 7,656 $ 4,327 $ — $(129) $ — $ 11,865

Accretion of and cumulative preferred

dividends on Series A Preferred Stock ..... — — — — — — — (1,994) — — — (1,994)

Dividends .............................. — — — — — — — (5,000) — — — (5,000)

Exercise of stock options .................. 690.0 1 — — — — 77 — — — — 78

Interest earned on notes receivable from

stockholders .......................... — — — — — — — — — (6) — (6)

Payments received on notes from

stockholders .......................... — — — — — — — — — 17 — 17

Comprehensive income: ..................

Net income ......................... — — — — — — — 16,322 — — — $16,322

Foreign currency translation adjustment,

netoftaxof$17 ................... — — — — — — — — — — (45) (45)

Comprehensive Income ............... 16,277 16,277

Balance as of December 31, 2004 .......... 31,890.0 11 — — 1,208.1 1 7,733 13,655 — (118) (45) 21,237

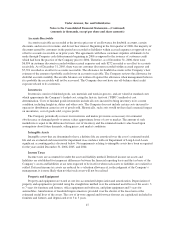

Issuance of Class A Common Stock, net of

issuance costs of $10,824 ............... 9,500.0 3 — — — — 112,673 — — — — 112,676

Convertible Common Stock held by Rosewood

entities converted to Class A Common

Stock ............................... 3,624.3 1 — — (1,208.1) (1) — — — — — —

Class A Common Stock converted to Class B

Common Stock .......................(15,200.0) (5) 15,200.0 5 — — — — — — — —

Accretion of and cumulative preferred

dividends on Series A Preferred Stock ..... — — — — — — — (5,307) — — — (5,307)

Exercise of stock options .................. 1,138.8 — — — — — 754 — — (262) — 492

Issuance of Class A Common Stock net of

forfeitures ............................ 270.3 — — — — — 2,291 — (1,793) — — 498

Stock options granted .................... — — — — — — 1,273 — (951) — — 322

Amortization of unearned compensation ...... — — — — — — — — 855 — — 855

Excess tax benefits from stock-based

compensation arrangements .............. — — — — — — 79 — — — — 79

Payments received on notes from

stockholders .......................... — — — — — — — — — 229 — 229

Interest earned on notes receivable from

stockholders .......................... — — — — — — — — — (12) — (12)

Comprehensive income ...................

Net income ......................... — — — — — — — 19,719 — — — 19,719

Foreign currency translation adjustment,

netoftax$2 ...................... — — — — — — — — — — 42 42

Comprehensive income ............... 19,761 19,761

Balance as of December 31, 2005 .......... 31,223.4 10 15,200.0 5 — — 124,803 28,067 (1,889) (163) (3) 150,830

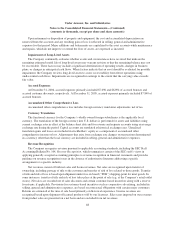

Class B Common Stock converted to Class A

Common Stock ....................... 1,950.0 1 (1,950.0) (1) — — — — — — — —

Exercise of stock options .................. 1,291.8 1 — — — — 2,955 — — — — 2,956

Issuance of fully vested warrants ............ — — — — — 8,500 — — — — 8,500

Shares withheld in consideration of employee

tax obligations relative to stock-based

compensation arrangements .............. (24.7) — — — — — (64) (670) — — — (734)

Issuance of Class A Common Stock net of

forfeitures ............................ 115.4 — — — — — 588 — — — — 588

Stock-based compensation expense .......... — — — — — — 1,235 — 711 — — 1,946

Excess tax benefits from stock-based

compensation arrangements .............. — — — — — — 11,260 — — — — 11,260

Reversal of unearned compensation and

additional paid in capital due to the adoption

of SFAS 123R ........................ — — — — — — (715) — 715 — — —

Payments received on notes from

stockholders .......................... — — — — — — — — — 169 — 169

Interest earned on notes receivable from

stockholders .......................... — — — — — — — — — (6) — (6)

Comprehensive income ...................

Net income ......................... — — — — — — — 38,979 — — — 38,979

Foreign currency translation adjustment,

netoftax$63 ..................... — — — — — — — — — — (100) (100)

Comprehensive income ............... — — — — — — — — — — — $38,879 38,879

Balance as of December 31, 2006 .......... 34,555.9 $ 12 13,250.0 $ 4 — $— $148,562 $66,376 $ (463) $ — $(103) $214,388

See accompanying notes.

44