Under Armour 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

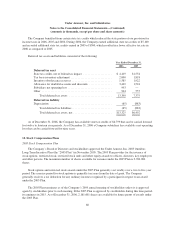

Reclassifications

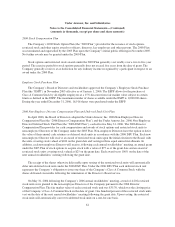

Certain balances in 2005 and 2004 have been reclassified to conform to the current year presentation. These

changes had no impact on previously reported results of operations or stockholders’ equity.

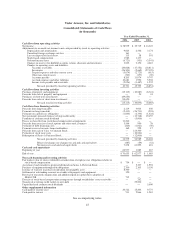

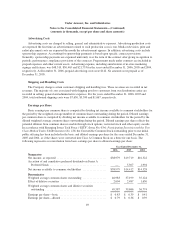

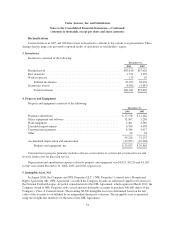

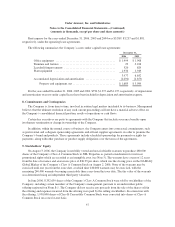

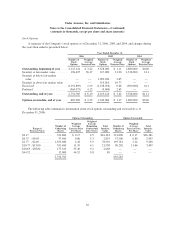

3. Inventories

Inventories consisted of the following:

December 31,

2006 2005

Finished goods .................................................... $83,618 $57,020

Raw materials .................................................... 1,321 1,379

Work-in-process .................................................. 133 95

Subtotal inventories ............................................ 85,072 58,494

Inventories reserve ................................................ (4,041) (4,887)

Total inventories .............................................. $81,031 $53,607

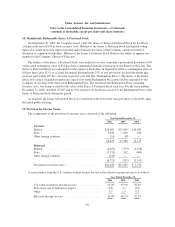

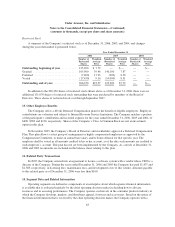

4. Property and Equipment

Property and equipment consisted of the following:

December 31,

2006 2005

Furniture and fixtures ............................................. $17,178 $ 12,262

Office equipment and software ..................................... 11,567 5,290

Plant equipment ................................................. 5,401 4,582

Leasehold improvements .......................................... 6,700 4,058

Construction in progress ........................................... 8,346 4,917

Other .......................................................... 24 24

49,216 31,133

Accumulated depreciation and amortization ........................... (19,293) (10,268)

Property and equipment, net .................................... $29,923 $ 20,865

Construction in progress primarily includes software costs relative to systems not yet placed in use and

in-store fixtures not yet placed in service.

Depreciation and amortization expense related to property and equipment was $9,021, $6,224 and $3,165

for the years ended December 31, 2006, 2005 and 2004, respectively.

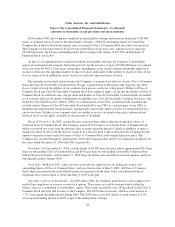

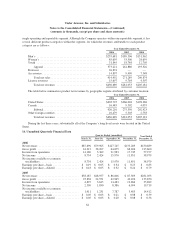

5. Intangible Asset, Net

In August 2006, the Company and NFL Properties LLC (“NFL Properties”) entered into a Promotional

Rights Agreement (the “NFL Agreement”) in which the Company became an authorized supplier of footwear to

the National Football League. As partial consideration for the NFL Agreement, which expires in March 2012, the

Company issued to NFL Properties fully vested and non-forfeitable warrants to purchase 480,000 shares of the

Company’s Class A Common Stock. The resulting $8,500 intangible asset was determined based on the fair

value of the warrants as established by an independent third party valuation. The intangible asset is amortized

using the straight-line method over the term of the NFL Agreement.

54