Ulta 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

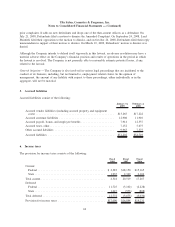

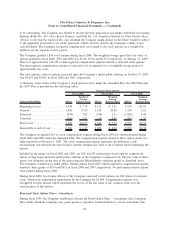

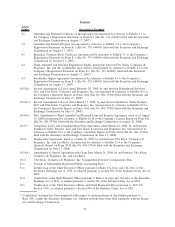

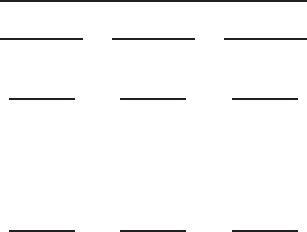

10. Net income per common share

The following is a reconciliation of net income and the number of shares of common stock used in the

computation of net income per basic and diluted share:

January 31,

2009

February 2,

2008

February 3,

2007

Fiscal Year Ended

Numerator for diluted net income per share — net income. . . $25,268 $25,335 $22,543

Less preferred stock dividends ....................... — 11,219 14,584

Numerator for basic net income per share ............... $25,268 $14,116 $ 7,959

Denominator for basic net income per share — weighted-

average common shares .......................... 57,425 20,383 5,771

Dilutive effect of stock options and non-vested stock....... 1,542 2,321 2,398

Dilutive effect of convertible preferred stock ............. — 30,589 41,752

Denominator for diluted net income per share ............ 58,967 53,293 49,921

Net income per common share:

Basic ........................................ $ 0.44 $ 0.69 $ 1.38

Diluted....................................... $ 0.43 $ 0.48 $ 0.45

The denominator for diluted net income per common share for fiscal years 2008, 2007 and 2006 exclude

3,758, 1,136 and 932 employee options, respectively, due to their anti-dilutive effects.

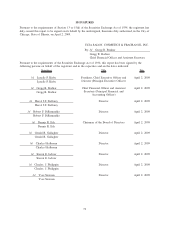

11. Employee benefit plans

The Company provides a 401(k) retirement plan covering all employees who qualify as to age, length of

service, and hours employed. In fiscal 2008, 2007, and 2006, the plan was funded through employee

contributions and a Company match of 40% up to 3% of eligible compensation. For fiscal years 2008, 2007

and 2006, the Company match was $437, $408 and $300, respectively.

On January 1, 2009, the Company established a non-qualified deferred compensation plan for highly

compensated employees whose contributions are limited under qualified defined contribution plans. Amounts

contributed and deferred under the plan are credited or charged with the performance of investment options

offered under the plan as elected by the participants. In the event of bankruptcy, the assets of this plan are

available to satisfy the claims of general creditors. The liability for compensation deferred under the

Company’s plan was insignificant at January 31, 2009, and is included in accrued liabilities. Total expense

recorded under this plan was also insignificant during fiscal 2008, and is included in selling, general and

administrative expenses. The Company manages the risk of changes in the fair value of the liability for

deferred compensation by electing to match its liability under the plan with investment vehicles that offset a

substantial portion of its exposure. The cash value of the investment vehicles was insignificant at January 31,

2009, and is included in cash and cash equivalents. Both the asset and the liability are carried at fair value.

12. Related-party transactions

During fiscal 1997, 1998, and 2001, certain officers of the Company were issued shares of Series V, IV, and I

Preferred Stock, respectively, in exchange for promissory notes. These notes bear interest at a rate of 6.85%

per annum and were due and payable at the earlier of 90 days after termination of employment or various

dates through November 4, 2007, subject to certain exceptions. These notes were fully repaid in fiscal 2007.

During fiscal 2006, an officer of the Company exercised stock options in exchange for a promissory note for

$4,094. The note bears interest at a rate of 5.06% per annum and was due at the earlier of an initial public

offering of the Company’s common stock or five years from issuance date. The note was paid in full on

June 29, 2007.

68

Ulta Salon, Cosmetics & Fragrance, Inc.

Notes to Consolidated Financial Statements — (Continued)