Ulta 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pre-opening expense includes non-capital expenditures during the period prior to store opening for new and

remodeled stores including store set-up labor, management and employee training, and grand opening

advertising. Pre-opening expenses also includes rent during the construction period related to new stores.

Interest expense includes interest costs associated with our credit facility, which is structured as an asset based

lending instrument. Our interest expense will fluctuate based on the seasonal borrowing requirements

associated with acquiring inventory in advance of key holiday selling periods and fluctuation in the variable

interest rates we are charged on outstanding balances. Our credit facility is used to fund seasonal inventory

needs and new and remodel store capital requirements in excess of our cash flow from operations. Our credit

facility interest is based on a variable interest rate structure which can result in increased cost in periods of

rising interest rates.

Income tax expense reflects the federal statutory tax rate and the weighted average state statutory tax rate for

the states in which we operate stores.

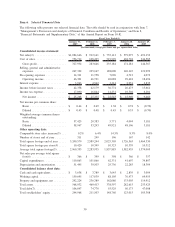

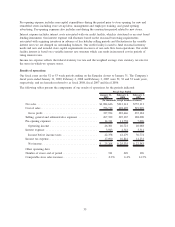

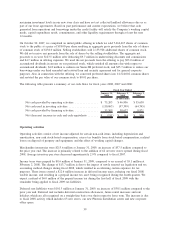

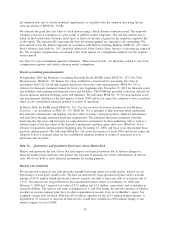

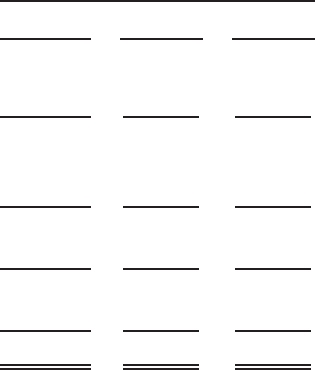

Results of operations

Our fiscal years are the 52 or 53 week periods ending on the Saturday closest to January 31. The Company’s

fiscal years ended January 31, 2009, February 2, 2008 and February 3, 2007 were 52, 52 and 53 week years,

respectively, and are hereafter referred to as fiscal 2008, fiscal 2007 and fiscal 2006.

The following tables present the components of our results of operations for the periods indicated:

January 31,

2009

February 2,

2008

February 3,

2007

Fiscal Year Ended

(In thousands, except number of stores)

Net sales....................................... $1,084,646 $912,141 $755,113

Cost of sales .................................... 756,712 628,495 519,929

Gross profit................................... 327,934 283,646 235,184

Selling, general and administrative expenses . . .......... 267,322 225,167 188,000

Pre-opening expenses ............................. 14,311 11,758 7,096

Operating income .............................. 46,301 46,721 40,088

Interest expense ................................. 3,943 4,542 3,314

Income before income taxes ...................... 42,358 42,179 36,774

Income tax expense............................... 17,090 16,844 14,231

Net income ................................... $ 25,268 $ 25,335 $ 22,543

Other operating data:

Number of stores end of period ...................... 311 249 196

Comparable store sales increase...................... 0.2% 6.4% 14.5%

35