Ulta 2008 Annual Report Download - page 46

Download and view the complete annual report

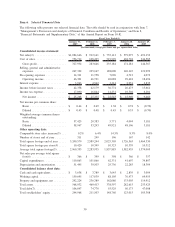

Please find page 46 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investing activities

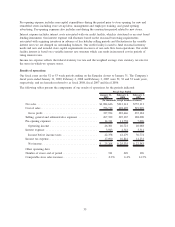

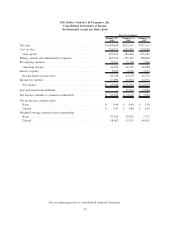

We have historically used cash primarily for new and remodeled stores as well as investments in information

technology systems. Investment activities primarily related to capital expenditures were $110.9 million in

fiscal 2008, compared to $101.9 million and $62.3 million in fiscal 2007 and 2006, respectively. Capital

expenditures were higher during fiscal 2008 due to the addition of a second distribution center and the number

of new store openings (63 new stores were opened during fiscal 2008, compared to 53 new stores during fiscal

2007 and 31 new stores during fiscal 2006).

During fiscal 2006, our Chief Executive Officer exercised stock options in exchange for a promissory note for

$4.1 million. The Company withheld $2.4 million of payroll-related taxes in connection with the exercised

options and that portion of the note has been classified as an investing activity in fiscal 2006. The remainder

of the promissory note of $1.7 million related to exercise proceeds of the options and was classified as a non-

cash financing activity. The note was paid in full on June 29, 2007.

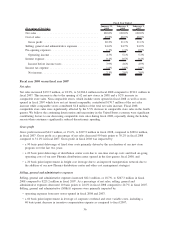

Financing activities

Financing activities consist principally of draws and payments on our credit facility and capital stock

transactions. The decrease in net cash provided by financing activities of $15.1 million in fiscal 2008

compared to fiscal 2007 is primarily the result of $25.7 million of net proceeds from the Company’s initial

public offering in fiscal 2007. This was partially offset by a $7.3 million increase in long-term borrowings in

fiscal 2008 due to an increase in new store capital expenditures and merchandise inventories. The remaining

difference is related to capital stock transactions.

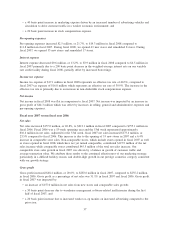

Credit facility

Our credit facility is with LaSalle Bank National Association as the administrative agent, Wachovia Capital

Finance Corporation as collateral agent, and JP Morgan Chase Bank as documentation agent. This facility

provides maximum credit of $200 million through May 31, 2011. The credit facility agreement contains a

restrictive financial covenant requiring us to maintain tangible net worth of not less than $80 million. On

January 31, 2009, our tangible net worth was approximately $245 million. Substantially all of our assets are

pledged as collateral for outstanding borrowings under the facility. Outstanding borrowings bear interest at the

prime rate or the Eurodollar rate plus 1.00% up to $100 million and 1.25% thereafter. The advance rates on

owned inventory are 80% (85% from September 1 to January 31).

The interest rate on the outstanding balances under the facility as of January 31, 2009 and February 2, 2008

was 1.52% and 4.81%, respectively. At January 31, 2009, we had $106.0 million of outstanding borrowings

under the facility. We have classified $88.0 million as long-term as this is the minimum amount we believe

will remain outstanding for an uninterrupted period over the next year. We had approximately $86.8 million

and $73.1 million (excluding the accordion option which was exercised on August 15, 2008) of availability as

of January 31, 2009 and February 2, 2008, respectively.

We also have an ongoing letter of credit that renews annually which had a balance of $0.3 million as of

January 31, 2009 and February 2, 2008.

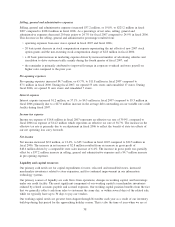

Seasonality

Our business is subject to seasonal fluctuation. Significant portions of our net sales and profits are realized

during the fourth quarter of the fiscal year due to the holiday selling season. To a lesser extent, our business is

also affected by Mothers’ Day as well as the “Back to School” season and Valentines’ Day. Any decrease in

sales during these higher sales volume periods could have an adverse effect on our business, financial

condition, or operating results for the entire fiscal year. Our quarterly results of operations have varied in the

past and are likely to do so again in the future. As such, we believe that period-to-period comparisons of our

results of operations should not be relied upon as an indication of our future performance.

40