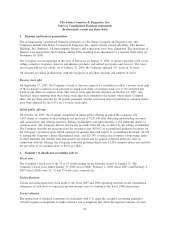

Ulta 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

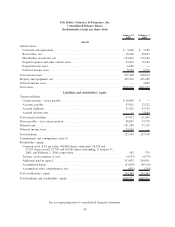

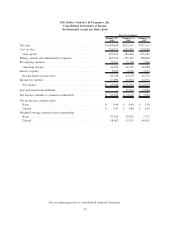

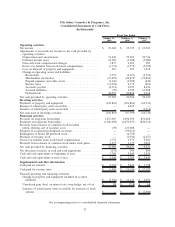

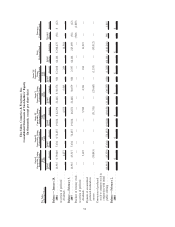

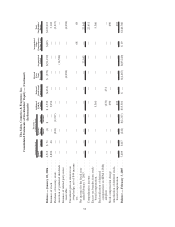

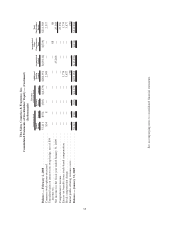

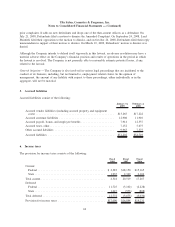

Ulta Salon, Cosmetics & Fragrance, Inc.

Consolidated Statements of Stockholders’ Equity — (Continued)

(In thousands)

Issued

Shares Amount

Treasury

Shares Amount

Additional

Paid-In

Capital

Deferred

Stock-based

Compensation

Related

Party

Notes

Receivable

Accumulated

Deficit

Accumulated

Other

Comprehensive

Income (Loss)

Total

Stockholders’

Equity

Common Stock

Treasury -

Common Stock

Shares Amount

Balance — January 28, 2006 ..... 4,513 $ 71 (1) $ — $ 6,533 $(431) $ (373) $(91,199) $(49) $123,015

Issuance of stock .............. 2,896 46 — — 3,056 — — — — 3,102

Purchase of treasury stock ........ — — (241) (2,217) — — — — — (2,217)

Accretion of preferred dividends . . . — — — — — — — (14,584) — —

Issuance of related party notes

receivable .................. — — — — — — (4,094) — — (4,094)

Unrealized gain on interest rate

swap hedge, net of $44 income

tax....................... — — — — — — — — 68 68

Net income for the fiscal year

ended February 3, 2007 ........ — — — — — — — 22,543 — 22,543

Comprehensive income .......... — — — — — — — — — 22,611

Excess tax benefits from stock-

based compensation........... — — — — 5,360 — — — — 5,360

Reclassification of deferred

compensation on SFAS 123(R)

adoption ................... — — — — (431) 431 — — — —

Stock compensation charge ....... — — — — 690 — — — — 690

Amortization of deferred stock-

based compensation........... — — — — 293 — — — — 293

Balance — February 3, 2007 ..... 7,409 $117 (242) $(2,217) $15,501 $ — $(4,467) $(83,240) $ 19 $148,760

53