Ulta 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

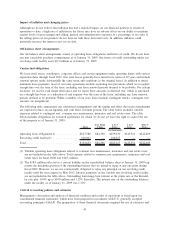

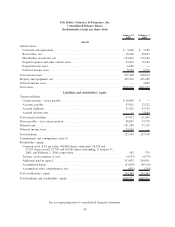

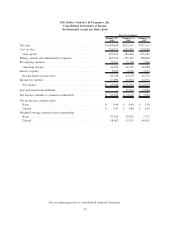

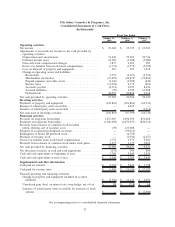

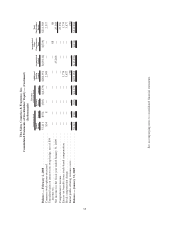

Ulta Salon, Cosmetics & Fragrance, Inc.

Consolidated Statements of Cash Flows

(In thousands)

January 31,

2009

February 2,

2008

February 3,

2007

Fiscal Year Ended

Operating activities

Net income .......................................... $ 25,268 $ 25,335 $ 22,543

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization .......................... 51,445 39,503 29,736

Deferred income taxes ................................ 22,583 (3,284) (3,080)

Non-cash stock compensation charges..................... 3,877 2,283 983

Excess tax benefits from stock-based compensation........... (1,774) (1,575) (5,360)

Loss on disposal of property and equipment ................ 267 195 3,518

Change in operating assets and liabilities:

Receivables ...................................... 2,375 (2,167) (2,719)

Merchandise inventories ............................. (37,493) (46,872) (19,863)

Prepaid expenses and other assets ...................... (5,110) (3,594) (449)

Income taxes ..................................... (11,918) 4,373 (421)

Accounts payable .................................. (4,311) 9,051 8,636

Accrued liabilities ................................. (59) 2,790 12,188

Deferred rent ..................................... 30,053 20,868 9,918

Net cash provided by operating activities .................... 75,203 46,906 55,630

Investing activities

Purchases of property and equipment ....................... (110,863) (101,866) (62,331)

Receipt of related party notes receivable..................... — 4,467 —

Issuance of related party notes receivable .................... — — (2,414)

Net cash used in investing activities ........................ (110,863) (97,399) (64,745)

Financing activities

Proceeds on long-term borrowings ......................... 1,217,969 1,094,590 851,468

Payments on long-term borrowings......................... (1,186,692) (1,070,557) (846,112)

Proceeds from issuance of common stock in initial

public offering, net of issuance costs ..................... (59) 123,608 —

Payment of accumulated dividends in arrears ................. — (93,012) —

Redemption of Series III preferred stock .................... — (4,792) —

Purchase of treasury stock ............................... — (1,950) (2,217)

Excess tax benefits from stock-based compensation ............ 1,774 1,575 5,360

Proceeds from issuance of common stock under stock plans ...... 2,517 1,175 1,422

Net cash provided by financing activities .................... 35,509 50,637 9,921

Net (decrease) increase in cash and cash equivalents............ (151) 144 806

Cash and cash equivalents at beginning of year ............... 3,789 3,645 2,839

Cash and cash equivalents at end of year .................... $ 3,638 $ 3,789 $ 3,645

Supplemental cash flow information

Cash paid for interest................................... $ 4,764 $ 5,429 $ 3,798

Cash paid for income taxes .............................. $ 6,509 $ 16,146 $ 17,193

Noncash investing and financing activities:

Change in property and equipment included in accrued

liabilities ........................................ $ (3,316) $ 12,141 $ 4,010

Unrealized gain (loss) on interest rate swap hedge, net of tax . . . $ 88 $ (738) $ 68

Issuance of related party notes receivable for exercise of stock

options.......................................... $ — $ — $ (1,680)

See accompanying notes to consolidated financial statements.

51