Ulta 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

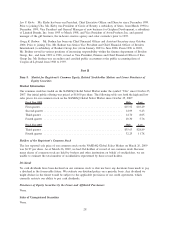

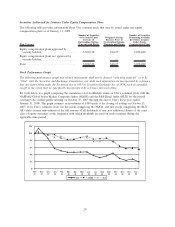

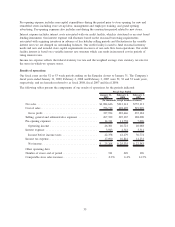

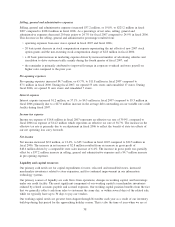

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information about Ulta common stock that may be issued under our equity

compensation plans as of January 31, 2009.

Plan Category

Number of Securities

to be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

Equity compensation plans approved by

security holders ...................... 5,300,338 $10.27 3,038,480

Equity compensation plans not approved by

security holders ...................... — — —

Total ............................... 5,300,338 $10.27 3,038,480

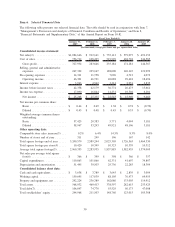

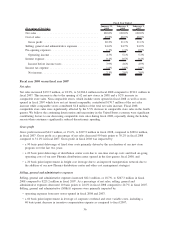

Stock Performance Graph

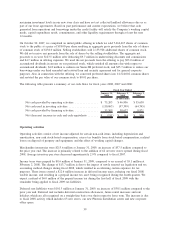

The following performance graph and related information shall not be deemed “soliciting material” or to be

“filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference

into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended,

except to the extent that we specifically incorporate it by reference into such filing.

Set forth below is a graph comparing the cumulative total stockholder return on Ulta’s common stock with the

NASDAQ Global Select Market Composite Index (NQGS) and the S&P Retail Index (RLX) for the period

covering Ulta’s initial public offering on October 25, 2007 through the end of Ulta’s fiscal year ended

January 31, 2009. The graph assumes an investment of $100 made at the closing of trading on October 25,

2007, in (i) Ulta’s common stock, (ii) the stocks comprising the NQGS, and (iii) stocks comprising the RLX.

All values assume reinvestment of the full amount of all dividends, if any, into additional shares of the same

class of equity securities at the frequency with which dividends are paid on such securities during the

applicable time period.

$120

$100

$80

$60

$40

$20

$0

Ulta NQGS RLX

Jan-

09

Dec-

08

Nov-

08

Oct-

08

Sep-

08

Aug-

08

Jul-

08

Jun-

08

May-

08

Apr-

08

Mar-

08

Feb-

08

Jan-

08

Dec-

07

Nov-

07

Oct-

07

29