Ulta 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Growth strategy

We intend to expand our presence as a leading retailer of beauty products and salon services by:

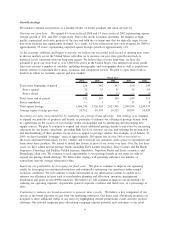

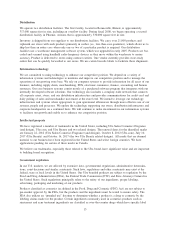

Growing our store base. We opened 63 stores in fiscal 2008 and 53 stores in fiscal 2007 representing square

footage growth of 25% and 28%, respectively. Due to the recent economic downturn, the number of high-

quality commercial real estate projects of the size and with the co-tenant mix that we typically target for our

new store locations has significantly declined. As a result, we have reduced our new store program for 2009 to

approximately 35 stores, representing expected square footage growth of approximately 11%.

As the economy stabilizes and begins to recover, we believe our successful track record of opening new stores

in diverse markets across the United States will allow us to increase our new store growth rates back to

historical levels consistent with our long-term targets. We believe that over the long-term, we have the

potential to grow our store base to over 1,000 Ulta stores in the United States. Our internal real estate model

takes into account a number of variables, including demographic and sociographic data as well as population

density relative to maximum drive times, economic and competitive factors. We plan to open stores both in

markets in which we currently operate and new markets.

2004 2005 2006 2007 2008

Fiscal Year

Total stores beginning of period .......... 126 142 167 196 249

Stores opened...................... 20 25 31 53 63

Stores closed ...................... (4) — (2) — (1)

Total stores end of period . .............. 142 167 196 249 311

Stores remodeled ..................... — 1 7 17 8

Total square footage ................... 1,464,330 1,726,563 2,023,305 2,589,244 3,240,579

Average square footage per store ......... 10,312 10,339 10,323 10,399 10,420

Increasing our sales and profitability by expanding our prestige brand offerings. Our strategy is to continue

to expand our portfolio of products and brands, in particular to enhance our offering of prestige brands, both

by capitalizing on the success of our existing vendor relationships and by identifying and developing new

supply sources. We plan to continue to expand and attract additional prestige brands to our stores by increasing

education for our beauty consultants, providing high levels of customer service, and tailoring the presentation

and merchandising of these products in our stores to appeal to prestige vendors. For example, as of January 31,

2009, we have installed “boutique” areas of approximately 200 square feet in over 160 of our stores to

showcase and build brand equity for key vendors and to provide our customers with a place to experiment and

learn about these products. We intend to install this feature in most of our stores over time. Over the last three

years, we have added several prestige brands including Estée Lauder fragrance, Juicy Couture and Ed Hardy

fragrances, Pureology and Frédéric Fekkai haircare, Smashbox, Napoleon Perdis and Lorac cosmetics, and

Dermalogica skin care. We continue to seek opportunities to test prestige brands in our stores in order to

expand our prestige brand offerings. We believe this strategy will positively influence our number of

transactions and our average transaction value.

Improving our profitability by leveraging our fixed costs. We plan to continue to improve our operating

results by leveraging our existing infrastructure and continually optimizing our operations under normal

economic conditions. We will continue to make investments in our information systems to enable us to

enhance our efficiency in areas such as merchandise planning and allocation, inventory management,

distribution and point of sale (POS) functions. We believe we will continue to improve our profitability by

reducing our operating expenses, in particular general corporate overhead and fixed costs, as a percentage of

sales.

Continuing to enhance our brand awareness to generate sales growth. We believe a key component of our

success is the brand exposure we get from our marketing initiatives. Our direct mail advertising programs are

designed to drive additional traffic to our stores by highlighting current promotional events and new product

offerings. Our national magazine print advertising campaign exposes potential new customers to our retail

6