Ulta 2008 Annual Report Download - page 70

Download and view the complete annual report

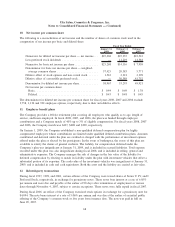

Please find page 70 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$80,000. On January 31, 2009, the Company’s tangible net worth was approximately $245,000. Substantially

all of the Company’s assets are pledged as collateral for outstanding borrowings under the facility. Outstanding

borrowings bear interest at the prime rate or the Eurodollar rate plus 1.00% up to $100,000 and 1.25%

thereafter. The advance rates on owned inventory are 80% (85% from September 1 to January 31).

The weighted-average interest rate on the outstanding borrowings as of January 31, 2009 and February 2,

2008, was 1.52% and 4.81%, respectively. At January 31, 2009, the Company had $106,047 of outstanding

borrowings under the facility. The Company has classified $88,047 as long-term as this is the minimum

amount that the Company believes will remain outstanding for an uninterrupted period over the next year. The

Company had approximately $86,764 and $73,140 (excluding the accordion option which was exercised on

August 15, 2008) of availability as of January 31, 2009 and February 2, 2008, respectively.

The Company has an ongoing letter of credit that renews annually in October, the balance of which was $326

as of January 31, 2009 and February 2, 2008.

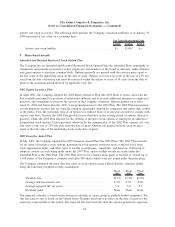

8. Financial instruments

The Company is exposed to certain risks relating to its ongoing business operations. The primary risk

managed by using derivative instruments is interest rate risk. Interest rate swaps are entered into to manage

interest rate risk associated with the Company’s variable-rate borrowings.

On January 31, 2007, the Company entered into an interest rate swap agreement with a notional amount of

$25,000 that qualified as a cash flow hedge to obtain a fixed interest rate on variable rate debt and reduce

certain exposures to interest rate fluctuations. The swap results in fixed rate payments at an interest rate of

5.11% for a term of three years.

As of January 31, 2009 and February 2, 2008, the interest rate swap had a negative fair value of $1,042 and

$1,184, respectively, and is included in accrued liabilities. The change in market value during fiscal 2008 and

2007 related to the effective portion of the cash flow hedge was recorded as an unrecognized gain or loss in

the accumulated other comprehensive loss section of stockholders’ equity in the consolidated balance sheets.

Amounts related to any ineffectiveness, which are insignificant, are recorded as interest expense.

Interest rate differentials paid or received under this agreement are recognized as adjustments to interest

expense. The Company does not hold or issue interest rate swap agreements for trading purposes. In the event

that a counter-party fails to meet the terms of the interest rate swap agreement, the Company’s exposure is

limited to the interest rate differential. The Company manages the credit risk of counterparties by dealing only

with institutions that the Company considers financially sound. The Company considers the risk of non-

performance to be remote.

On February 3, 2008, the Company adopted SFAS No. 157, Fair Value Measurements, for financial assets and

liabilities. The adoption had no impact on the Company’s consolidated financial statements. SFAS No. 157

established a three-tier hierarchy for fair value measurements, which prioritizes the inputs used in measuring

fair value as follows:

a. Level 1 — observable inputs such as quoted prices for identical instruments in active markets.

b. Level 2 — inputs other than quoted prices in active markets that are observable either directly or

indirectly through corroboration with observable market data.

c. Level 3 — unobservable inputs in which there is little or no market data, which would require the

Company to develop its own assumptions.

The Company’s interest rate swap is required to be measured at fair value on a recurring basis. The fair value

of the interest rate swap is determined based on inputs that are readily available in public markets or can be

derived from information available in publicly quoted markets. Therefore, the Company has categorized the

64

Ulta Salon, Cosmetics & Fragrance, Inc.

Notes to Consolidated Financial Statements — (Continued)