Ulta 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from time to time, provide critical services to the Company. Options are granted with the exercise price equal

to the fair value of the underlying stock on the date of grant. Options vest over varying time periods

depending on the arrangement with each consultant and must be exercised within 4 years and 90 days from

the date of grant.

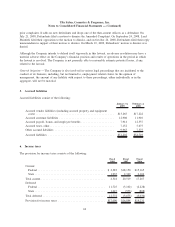

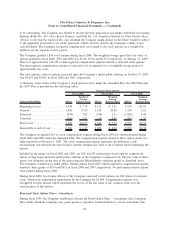

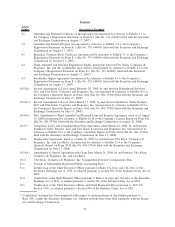

A following table presents summary information related to the Company’s common stock option activity under

the Consultant Plan, which does not apply to fiscal 2008 and 2007:

Options Outstanding Shares

Weighted-

Average

Exercise

Price

Fiscal 2006

Beginning of year ............................................... 13 $1.11

Exercised ..................................................... (13) 1.11

Canceled...................................................... — —

End of year.................................................... — $ —

Exercisable at end of year ......................................... — $ —

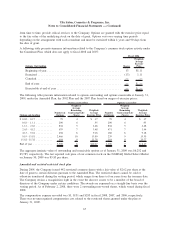

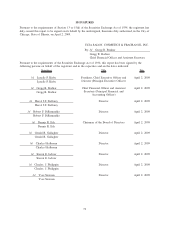

The following table presents information related to options outstanding and options exercisable at January 31,

2009, under the Amended Plan, the 2002 Plan and the 2007 Plan based on ranges of exercise prices:

Options outstanding

Number of

Options

Weighted-

Average

Remaining

Contractual Life

(Years)

Weighted-

Average

Exercise Price

Number

of Options

Weighted-

Average

Remaining

Contractual Life

(Years)

Weighted-

Average

Exercise Price

Options outstanding Options exercisable

$ 0.02 - 0.17 . . . . . . . . . . . 79 4 $ .17 79 4 $ .17

0.18 - 1.11 . . . . . . . . . . . 290 6 .95 290 6 .95

1.12 - 2.62 . . . . . . . . . . . 834 5 2.48 834 5 2.48

2.63 - 4.12 . . . . . . . . . . . 679 7 3.48 471 7 3.44

4.13 - 9.18 . . . . . . . . . . . 458 8 9.18 180 8 9.18

9.19 - 15.81 . . . . . . . . . . . 2,466 10 13.89 239 9 15.55

15.82 - 25.32 . . . . . . . . . . . 494 9 22.78 203 9 23.77

End of year . . . . . . . . . . . . . 5,300 8 $10.27 2,296 7 $ 6.17

The aggregate intrinsic value of outstanding and exercisable options as of January 31, 2009 was $6,252 and

$5,785, respectively. The last reported sale price of our common stock on the NASDAQ Global Select Market

on January 30, 2009 was $5.83 per share.

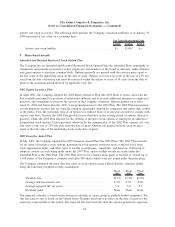

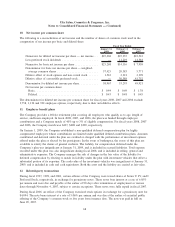

Amended and restated restricted stock plan

During 2004, the Company issued 442 restricted common shares with a fair value of $2.62 per share at the

date of grant to certain directors pursuant to the Amended Plan. The restricted shares cannot be sold or

otherwise transferred during the vesting period, which ranges from three to four years from the issuance date.

The Company retains a reacquisition right in the event the director ceases to be a member of the board of

directors of the Company under certain conditions. The awards are expensed on a straight-line basis over the

vesting period. As of February 2, 2008, there were 2 outstanding non-vested shares, which vested during fiscal

2008.

The compensation expense recorded was $5, $131 and $293 in fiscal 2008, 2007, and 2006, respectively.

There was no unrecognized compensation cost related to the restricted shares granted under the plan at

January 31, 2009.

67

Ulta Salon, Cosmetics & Fragrance, Inc.

Notes to Consolidated Financial Statements — (Continued)