Ulta 2008 Annual Report Download - page 62

Download and view the complete annual report

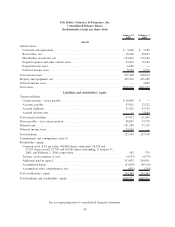

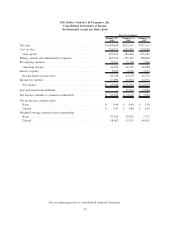

Please find page 62 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Ulta Salon, Cosmetics & Fragrance, Inc.

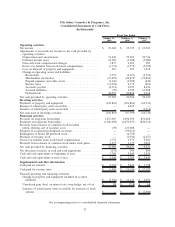

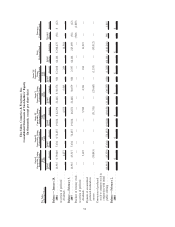

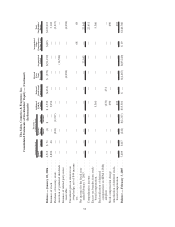

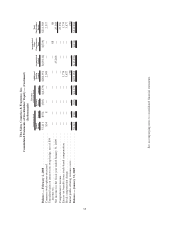

Notes to Consolidated Financial Statements

(In thousands, except per share data)

1. Business and basis of presentation

The accompanying consolidated financial statements of Ulta Salon, Cosmetics & Fragrance, Inc. (the

Company) include Ulta Salon, Cosmetics & Fragrance, Inc. and its wholly owned subsidiary, Ulta Internet

Holdings, Inc. (Internet). All intercompany balances and transactions have been eliminated. The operations of

Internet were merged into the Company during 2006, resulting in its dissolution as a separate legal entity on

November 30, 2006.

The Company was incorporated in the state of Delaware on January 9, 1990, to operate specialty retail stores

selling cosmetics, fragrance, haircare and skincare products, and related accessories and services. The stores

also feature full-service salons. As of January 31, 2009, the Company operated 311 stores in 36 states.

All amounts are stated in thousands, with the exception of per share amounts and number of stores.

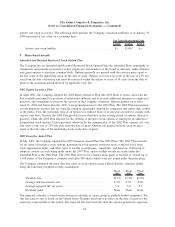

Reverse stock split

On September 17, 2007, the Company’s board of directors approved a resolution to effect a reverse stock split

of the Company’s common stock pursuant to which each share of common stock was to be converted into

0.632 of one share of common stock. The reverse stock split became effective on October 22, 2007. Any

fractional shares resulting from the reverse stock split were rounded to the nearest whole share. Common

share and per share amounts for all periods presented and the conversion ratio of preferred to common shares

have been adjusted for the 0.632 for 1 reverse stock split.

Initial public offering

On October 30, 2007, the Company completed an initial public offering in which the Company sold

7,667 shares of common stock resulting in net proceeds of $123,549 after deducting underwriting discounts

and commissions and offering expenses. Selling stockholders sold approximately 2,154 additional shares of

common stock. The Company did not receive any proceeds from the sale of shares by the selling stockholders.

The Company used the net proceeds from the offering to pay $93,012 of accumulated dividends in arrears on

the Company’s preferred stock, which satisfied all amounts due with respect to accumulated dividends, $4,792

to redeem the Company’s Series III preferred stock, and $25,745 to reduce the Company’s borrowings under

its third amended and restated loan and security agreement and for general corporate purposes. Also in

connection with the offering, the Company converted preferred shares into 41,524 common shares and restated

the par value of its common stock to $0.01 per share.

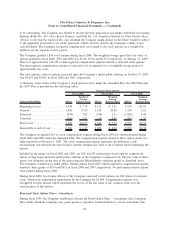

2. Summary of significant accounting policies

Fiscal year

The Company’s fiscal year is the 52 or 53 weeks ending on the Saturday closest to January 31. The

Company’s fiscal years ended January 31, 2009 (fiscal 2008), February 2, 2008 (fiscal 2007) and February 3,

2007 (fiscal 2006) were 52, 52 and 53 week years, respectively.

Reclassifications

Certain reclassifications have been made to the fiscal 2007 and 2006 operating activities in the consolidated

statements of cash flows to separately present income taxes to conform to the fiscal 2008 presentation.

Use of estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles

(GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets

56