Ulta 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

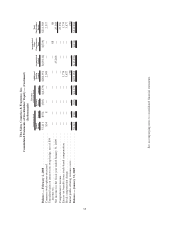

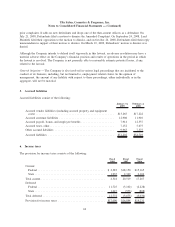

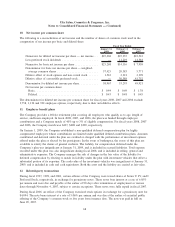

interest rate swap as Level 2. The following table presents the Company’s financial liabilities as of January 31,

2009 measured at fair value on a recurring basis:

Level 1 Level 2 Level 3

Fair Value Measurement Using

Interest rate swap liability................................... $— $1,042 $—

9. Share-based awards

Amended and Restated Restricted Stock Option Plan

The Company has an Amended and Restated Restricted Stock Option Plan (the Amended Plan), principally to

compensate and provide an incentive to key employees and members of the board of directors, under which it

may grant options to purchase common stock. Options generally are granted with the exercise price equal to

the fair value of the underlying stock on the date of grant. Options vest over four years at the rate of 25% per

year from the date of issuance and must be exercised within the earlier to occur of 14 years from the date of

grant or the maximum period allowed by applicable state law.

2002 Equity Incentive Plan

In April 2002, the Company adopted the 2002 Equity Incentive Plan (the 2002 Plan) to attract and retain the

best available personnel for positions of substantial authority and to provide additional incentive to employees,

directors, and consultants to promote the success of the Company’s business. Options granted on or after

April 26, 2002 and before October 2007, were granted pursuant to the 2002 Plan. The 2002 Plan incorporates

several important features that are typically found in agreements adopted by companies that report their results

to the public. First, the maximum term of an option was reduced from 14 to ten years in order to comply with

various state laws. Second, the 2002 Plan provided more flexibility in the vesting period of options offered to

grantees. Third, the 2002 Plan allowed for the offering of incentive stock options to employees in addition to

nonqualified stock options. Unless provided otherwise by the administrator of the 2002 Plan, options vest over

four years at the rate of 25% per year from the date of grant. Options are granted with the exercise price

equal to the fair value of the underlying stock on the date of grant.

2007 Incentive Award Plan

In July 2007, the Company adopted the 2007 Incentive Award Plan (the 2007 Plan). The 2007 Plan provides

for the grant of incentive stock options, nonstatutory stock options, restricted stock, restricted stock units,

stock appreciation rights, and other types of awards to employees, consultants, and directors. Following its

adoption, awards are only being made under the 2007 Plan, and no further awards are made under the

Amended Plan or the 2002 Plan. The 2007 Plan reserves for issuance upon grant or exercise of awards up to

4,108 shares of the Company’s common stock plus 598 shares which were not issued under the prior plans.

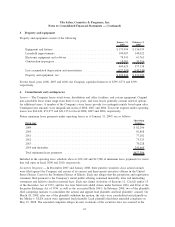

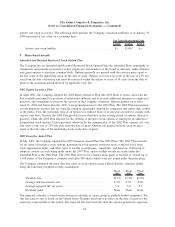

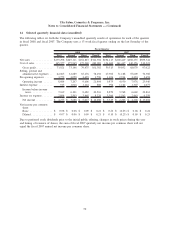

The Company estimated the grant date fair value of stock options using a Black-Scholes valuation model

using the following weighted-average assumptions:

Fiscal

2008

Fiscal

2007

Fiscal

2006

Volatility rate ............................................ 48.7% 37.0% 45.0%

Average risk-free interest rate ................................ 2.3% 4.7% 4.8%

Average expected life (in years) . . . ........................... 5.2 5.0 5.5

Dividend yield ........................................... None None None

The expected volatility is based on the historical volatility of a peer group of publicly-traded companies. The

risk free interest rate is based on the United States Treasury yield curve in effect on the date of grant for the

respective expected life of the option. The expected life represents the time the options granted are expected

65

Ulta Salon, Cosmetics & Fragrance, Inc.

Notes to Consolidated Financial Statements — (Continued)