TJ Maxx 1999 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

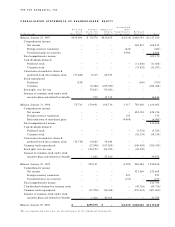

T h e T J X C o m p a n i e s , I n c .

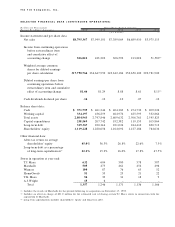

S E L E C T E D I N F O R M A T I O N B Y M A J O R B U S I N E S S S E G M E N T

Fi scal Ye a r E n d e d

Ja n u a ry 2 9 , Ja n u a ry 3 0, Ja nu a ry 3 1 ,

I n Th o u s a n d s 2 0 0 0 1 9 9 9 1 9 9 8

( 5 3 w e e k s )

Net sales:

Off-price family apparel stores $8,588,537 $7,816,563 $7,290,959

Off-price home fashion stores 206,810 132,538 98,110

$8,795,347 $7,949,101 $7,389,069

Operating income (loss):

Off-price family apparel stores $ 896,492 $ 782,706 $ 596,908

Off-price home fashion stores(1) 4,581 (4,950) (8,615)

901,073 777,756 588,293

General corporate expense (2) 37,182 69,449 58,906

Goodwill amortization 2,609 2,609 2,614

Interest expense, net 7,345 1,686 4,502

Income from continuing operations before income

taxes, extraordinary item and cumulative effect of

accounting change $ 853,937 $ 704,012 $ 522,271

Identifiable assets:

Off-price family apparel stores $2,189,403 $2,093,879 $2,033,945

Off-price home fashion stores 63,888 49,515 39,074

Corporate, primarily cash, goodwill and deferred taxes 551,672 604,452 536,613

$2,804,963 $2,747,846 $2,609,632

Capital expenditures:

Off-price family apparel stores $ 227,750 $ 202,054 $ 190,720

Off-price home fashion stores 10,819 5,688 1,662

$ 238,569 $ 207,742 $ 192,382

Depreciation and amortization:

Off-price family apparel stores $ 153,525 $ 130,325 $ 115,967

Off-price home fashion stores 3,911 3,302 3,186

Corporate, including goodwill 2,957 2,904 5,738

$ 160,393 $ 136,531 $ 124,891

( 1 ) The periods ended Ja n u a ry 30, 1999 and Ja n u a ry 31, 1998 include a pre-tax charge of $2.2 million and $1.5 million, re s p e c t ive ly,

for certain store closings and other re s t ructuring costs re l ating to HomeGoods.

( 2 ) G e n e ral corp o rate expense for the fiscal year ended Ja n u a ry 29, 2 0 0 0 , includes a pre-tax gain of $8.5 million associated with the

C o m p a ny ’s receipt of common stock resulting from the demutualization of Manulife Financial and a pre-tax charge of $1.1 million

for costs associated with a fiscal 1998 exe c u t ive defe r red compensation awa rd . G e n e ral corp o rate expense for the fiscal year ended

Ja n u a ry 30, 1999 includes a pre-tax charge of $6.3 million for costs associated with the fo re going exe c u t ive defe r red compensat i o n

awa rd , a $3.5 million pre-tax charge for the write-down of a note re c e ivable from the Company ’s former Hit or Miss division and a

$7.5 million charitable donation to The TJX Fo u n d at i o n . G e n e ral corp o rate expense for the fiscal year ended Ja n u a ry 31, 1 9 9 8

includes a pre-tax charge of $15.2 million for costs associated with the fo re going exe c u t ive defe r red compensation awa rd and a pre -

tax gain of $6.0 million for the sale of Bry l a n e, I n c . common stock.