TJ Maxx 1999 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

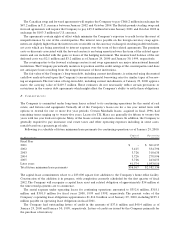

Fi scal Ye a r E n d e d

Ja n u a ry 2 9 , Ja n u a ry 3 0, Ja nu a ry 3 1 ,

I n Th o u s a n d s 2 0 0 0 1 9 9 9 1 9 9 8

Balance at beginning of year $ 44,598 $ 57,966 $ 95,867

Additions to the reserve –1,961 –

Reserve adjustments:

Adjust Marshalls restructuring reserve (3,000) – (15,843)

Adjust T.J. Maxx store closing reserve (300) (1,800) 700

Charges against the reserve:

Lease related obligations (23,734) (12,521) (13,593)

Severance and all other cash charges –(927) (1,876)

Net activity relating to HomeGoods closings (1,833) (81) (1,887)

Non-cash property write-offs –– (5,402)

Balance at end of year $ 15,731 $ 44,598 $ 57,966

The use of the reserve will reduce operating cash flows in varying amounts over the next ten to fifteen years as

the related leases reach their expiration dates or are settled.

K . S u p pl e m e n t a l C a sh F lo w s I n f o r m a t i o n

There were no cash flows attributable to the operating results of the Company’s discontinued operations during

the years ended January 29, 2000 or January 30, 1999.The cash provided by discontinued operations for fiscal

1998 represents the collection of the balance of the credit card receivables retained by the Company upon the

sale of its former Chadwick’s division. The Company is also responsible for certain leases related to, and other

obligations arising from, the sale of these operations, for which reserves have been provided in its reserve for

discontinued operations. These reserves are included in accrued expenses. The cash flow impact of these obliga-

tions is reflected as a component of cash provided by operating activities in the statements of cash flows.

The Company’s cash payments for interest and income taxes, including discontinued operations, and its non-

cash investing and financing activities are as follows:

Fi scal Ye a r E n d e d

Ja n u a ry 2 9 , Ja n u a ry 3 0, Ja nu a ry 3 1 ,

I n Th o u s a n d s 2 0 0 0 1 9 9 9 1 9 9 8

( 5 3 w e e k s )

Cash paid for:

Interest $ 19,018 $ 22,542 $ 26,359

Income taxes 332,622 275,538 199,025

Non-cash investing and financing activities:

Conversion of Series E cumulative convertible

preferred stock into common stock –$ 72,730 $ 77,020

Distribution of two-for-one stock split –158,954 79,823

Change in accrued expenses due to:

Stock repurchase (3,300) 12,575 –

Dividends payable 977 1,246 1,973

L . D i sc o n t in u e d O p e ra t i o n s a n d R e la te d C o n t in ge n t L i a b ilit i e s

In October 1988, the Company completed the sale of its former Zayre Stores division to Ames Department

Stores,Inc. (“Ames”). In April 1990,Ames filed for protection under Chapter 11 of the Federal Bankruptcy Code

and in December 1992,Ames emerged from bankruptcy under a plan of reorganization.