TJ Maxx 1999 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

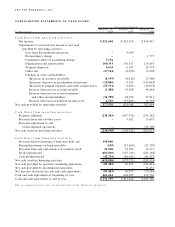

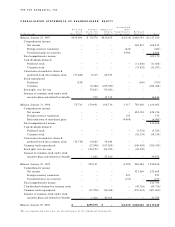

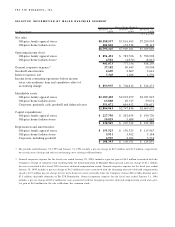

The aggregate maturities of long-term debt, exclusive of current installments, at January 29, 2000 are as follows:

G e n e ra l

E q u i p m e n t C o r p o ra t e

I n Th o u s a n d s N o t e s D eb t To t a l

Fiscal Year

2002 $73 $ – $ 73

2003 – – –

2004 – 15,000 15,000

2005 – 5,000 5,000

Later years – 299,294 299,294

Aggregate maturities of long-term debt,

exclusive of current installments $73 $319,294 $319,367

In June 1995, the Company issued $200 million of long-term notes; $100 million of 65/8% notes due June 15,

2000 and $100 million of 7% notes due June 15, 2 0 0 5 . The proceeds we re used in part to re p ay short-term

b o r rowings and for ge n e ral corp o rate purp o s e s , including the re p ayment of scheduled maturities of other

outstanding long-term debt and for new store and other capital ex p e n d i t u re s . In December 1999, the Company

issued $200 million of 7.45% ten-year notes, the proceeds of which are being used for ge n e ral corp o rate purp o s e s ,

including the Company ’s ongoing stock re p u rchase pro g ra m .

The Company periodically enters into financial instruments to manage its cost of borrowing. In December

1999, the Company entered into a rate-lock agreement to hedge the underlying treasury rate of the $200 million

ten-year notes, prior to their issuance. The cost of this agreement has been deferred and is being amortized to

interest expense over the term of the notes and resulted in an effective rate of 7.6% on the debt.

On November 17, 1995, the Company entered into an unsecured $875 million bank credit agreement which

allowed the Company to borrow up to $500 million on a revolving loan basis to fund the working capital needs

of the Company. In September 1997, the Company replaced this credit agreement with a new five-year $500

million revolving credit facility. The Company recorded an extraordinary charge of $1.8 million, net of income

taxes of $1.2 million, associated with the write-off of deferred financing costs of the former agreement.The new

agreement provides for reduced commitment fees on the unused portion of the line, as well as lower borrowing

costs and has certain financial covenants which require that the Company maintain specified fixed charge cover-

age and leverage ratios.

As of January 29, 2000, all $500 million of the revolving credit facility was available for use. Interest is

payable on borrowings at rates equal to or less than prime. The revolving credit facility is used as backup to the

Company’s commercial paper program. The maximum amount outstanding under this credit agreement during

fiscal 2000 was $108 million.There were no borrowings under this facility during fiscal 1999.The weighted aver-

age interest rate on the Company’s short-term borrowings under this agreement was 6.06% in fiscal 2000. The

Company does not have any compensating balance requirements under these arrangements.The Company also

has C$40 million of credit lines for its Canadian operation, all of which were available as of January 29, 2000.

D. Fin a n ci a l I n st ru m e n t s

The Company periodically enters into forward foreign exchange contracts to hedge firm U.S. dollar and Euro

dollar merchandise purchase commitments made by its foreign subsidiaries. As of January 29, 2000, the

Company had $21.4 million of such contracts outstanding for its Canadian subsidiary and $4.3 million and 2.5

million Euro dollars for its subsidiary in the United Kingdom. The contracts cover certain commitments for the

first quarter of fiscal 2001 and any gains or losses on the contracts will ultimately be reflected in the cost of the

merchandise. Deferred gains and losses on the contracts as of January 29, 2000 were immaterial.

The Company also has entered into seve r al fo reign curre n c y swap and fo r wa rd contracts in both Canadian

d o l l a rs and British pounds sterl i n g . Both the swap and fo r wa rd agreements are accounted for as a hedge against the

C o m p a ny ’s investment in fo reign subsidiaries; thus, fo reign ex c h a n g e gains and losses on the agreements are re c o g-

n i zed in share h o l d e rs’ equity thereby offsetting tra n s l ation adjustments associated with the Company ’s inve s t m e n t

in fo reign operat i o n s .The gains and losses on this hedging activity as of Ja n u a ry 29, 2000 we re immat e r i a l .