TJ Maxx 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

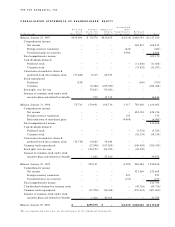

F. S t o ck C o m p e n s a t i o n P la n s

In the following note, all references to historical awards, outstanding awards and availability of shares for future

grants under the Company’s stock incentive plans and related prices per share have been restated, for compara-

bility purposes, for the two-for-one stock splits distributed in June 1998 and June 1997.

The Company has a Stock Incentive Plan under which options and other stock awards may be granted to

certain officers and key employees. The Stock Incentive Plan, as amended, provides for the issuance of up to 42

million shares with 12.5 million shares available for future grants as of January 29, 2000.The Company also has

a Directors’ Stock Option Plan under which stock options are granted to directors who are not otherwise

employed by the Company. This plan provides for the issuance of up to 200,000 shares.There are 66,000 shares

available for future grants under this plan as of January 29, 2000.

Under its stock option plans, the Company has granted options for the purchase of common stock, generally

within ten years from the grant date at option prices of 100% of market price on the grant date. Most options

outstanding are exercisable at various percentages starting one year after the grant, while certain options are

exercisable in their entirety three years after the grant date. Options granted to directors become fully exercis-

able one year after the date of grant.

A summary of the status of the Company’s stock options and related Weighted Average Exercise Prices

(“WAEP”),adjusted for the two-for-one stock splits distributed in June 1998 and June 1997, is presented below

(shares in thousands):

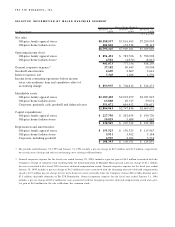

Fi scal Ye a r E n d e d

Ja n u a ry 2 9 , 2 0 0 0 Ja n u a ry 3 0 , 1 9 9 9 Jan u a ry 3 1 , 1 9 9 8

S h a re s WA E P S h a re s W A E P S h a re s W A E P

Outstanding at beginning of year 10,105 $12.04 10,507 $ 9.04 8,192 $ 6.10

Granted 3,164 29.26 1,964 21.77 4,338 12.97

Exercised (1,275) 7.13 (2,215) 6.31 (1,756) 5.31

Canceled (162) 20.52 (151) 13.35 (267) 7.31

Outstanding at end of year 11,832 17.06 10,105 12.04 10,507 9.04

Options exercisable at end of year 5,980 $10.77 4,796 $ 8.01 3,932 $ 5 . 8 9

Virtually all canceled options are forfeitures.The Company realizes an income tax benefit from the exercise of

stock options which results in a decrease in current income taxes payable and an increase in additional paid-in

capital. Such benefits amounted to $11.7 million, $13.8 million and $6.1 million for the fiscal years ended Janu-

ary 29, 2000, January 30, 1999 and January 31, 1998, respectively.

The Company has adopted the disclosure-only provisions of Statement of Financial Accounting Standards

(SFAS) No. 123, “Accounting for Stock-Based Compensation,” and continues to apply the provisions of Account-

ing Principles Board (APB) Opinion No. 25, “Accounting for Stock Issued to Employees,” in accounting for

compensation expense under its stock option plans.The Company grants options at fair market value on the date

of the grant; accordingly, no compensation expense has been recognized for the stock options issued during fiscal

years 2000, 1999 or 1998. Compensation expense determined in accordance with SFAS No. 123, net of related

income taxes, would have amounted to $12.9 million, $8.7 million and $5.5 million for fiscal 2000, fiscal 1999

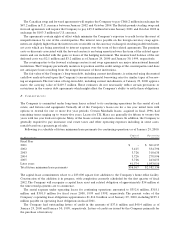

and fiscal 1998, respectively. Income from continuing operations, net income and related earnings per share

amounts presented on a pro forma basis are as follows: