TJ Maxx 1999 Annual Report Download - page 14

Download and view the complete annual report

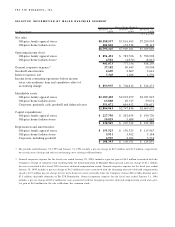

Please find page 14 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.which these awards vest, such pre-tax charges amounted to $1.1 million, $619,000 and $2.7 million in fiscal

years 2000, 1999 and 1998, respectively. The market value of the awards is determined at date of grant for

restricted stock awards, and at the date shares are earned for performance based awards.

There has been a combined total of 131,480 shares,4,000 shares and 1,023,834 shares for deferred, restricted

and performance based awards issued in the fiscal years ended January 2000, 1999 and 1998, respectively.There

were 3,000 and 300,000 shares forfeited for the fiscal years ended January 2000 and 1998, respectively.There

were no shares forfeited during the fiscal year ended January 1999.The weighted average market value per share

of these stock awards at grant date was $29.55, $18.03 and $10.89 for fiscal 2000, 1999 and 1998, respectively.

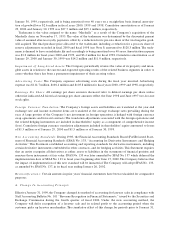

During fiscal 1998, the Company formed a deferred stock compensation plan for its outside directors which

replaced the Company’s retirement plan for directors. Each director’s deferred stock account has been credited

with deferred stock to compensate for the value of such director’s accrued retirement benefit.Additional share

awards valued at $10,000 are issued annually to each eligible director. Currently, there are 27,391 deferred

shares outstanding, actual shares will be issued at retirement.The Company has 100,000 shares held in treasury

from which such shares will be issued.

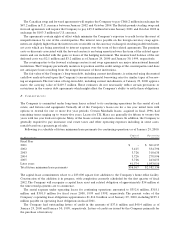

G . Ca p it a l S t o ck a n d E a rn in gs Pe r S h a re

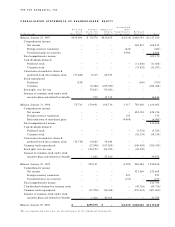

C a p ita l St o ck : The Company distributed a two-for-one stock split, effected in the form of a 100% stock divi-

dend, on June 25, 1998 to shareholders of record on June 11, 1998, which resulted in the issuance of 158.9

million shares of common stock and corresponding decreases of $96.5 million in additional paid-in capital and

$62.4 million in retained earnings. Similar transfers were made between additional paid-in capital and common

stock in the amount of $79.8 million, reflecting the two-for-one stock split of June 26, 1997 to shareholders of

record on June 11, 1997.All historical earnings per share amounts have been restated to reflect both two-for-

one stock splits. Reference to common stock activity before the distribution of the related stock split has not

been restated unless otherwise noted.All activity after the distribution date reflects the two-for-one stock splits.

On November 17, 1 9 9 5 , the Company issued 1.5 million shares of Series E cumulat ive conve r t i ble pre fe r re d

stock as part of the purchase price for Mars h a l l s .The shares of Series E pre fe r red stock, i n i t i a l l y issued at a fa c e

value of $150 million, carried an annual dividend rate of $7.00 per share. During fiscal 1998, 770,200 shares of

the Series E pre fe r red stock we re vo l u n t a r i l y converted into 8.3 million shares of common stock and 2,500 share s

we re re p u rc h a s e d . During fiscal 1999, 357,300 shares of Series E we re vo l u n t a r i ly converted into 6.7 million

s h a res of common stock. On November 18, 1 9 9 8 , the remaining 370,000 shares of the Series E pre fe r red stock

we re mandat o r i ly converted into 8.0 million shares of common stock in accordance with its terms. I n d u c e m e n t

fees of $130,000 and $3.8 million we re paid on the Series E vo l u n t a ry conve rsions in fiscal 1999 and fiscal 1998,

re s p e c t ive l y. The Company re c o rded ag g re gate div i d e n d s , including inducement fe e s , on its pre fe r red stock of $3.5

million in fiscal 1999 and $11.7 million in fiscal 1998. The pre fe r red dividends reduce net income in computing

net income ava i l able to common share h o l d e rs . As of Ja n u a ry 29, 2 0 0 0 , the Company has authorization for the

issuance of up to 5 million shares of pre fe r red stock with none issued or outstanding at Ja n u a ry 29, 2 0 0 0 .

In June 1997, the Company announced a $250 million stock re p u rchase pro gra m . During fiscal 1998, t h e

C o m p a ny re p u rchased and re t i red 17.1 million shares of common stock (adjusted for stock splits) for a cost of

$245.2 million.The pro gram was completed in Feb ru a ry 1998, at which time the Company announced a second

$250 million stock re p u rchase pro gra m . In October 1998, the Company completed the second $250 million

stock re p u rchase pro gra m , h aving re p u rchased 8.7 million share s , and announced its intentions to re p u rc h a s e

an additional $750 million of common stock over the next seve ral ye a rs . The Company spent $601.3 million

and $95.5 million through Ja n u a ry 29, 2000 and Ja n u a ry 30, 1 9 9 9 , re s p e c t i ve ly, on this re p u rchase pro gra m .

In total, t h rough Ja n u a ry 29, 2 0 0 0 , the Company re p u rchased and re t i red 27.7 million shares under the $750

million re p u rchase pro gra m . Subsequent to ye a r- e n d , the Company re p u rchased an additional 2.7 million

s h a re s , completing the $750 million stock re p u rchase pro gram and announced a new multi-ye a r, $1 billion

stock re p u rchase pro g ra m .