TJ Maxx 1999 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

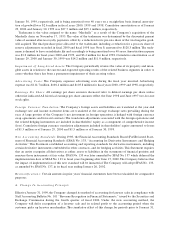

The Canadian swap and forward agreements will require the Company to pay C$66.2 million in exchange for

$47.2 million in U.S. currency between January 2002 and October 2004.The British pounds sterling swap and

forward agreements will require the Company to pay £65.0 million between January 2001 and October 2002 in

exchange for $103.3 million in U.S. currency.

The agreements contain rights of offset which minimize the Company’s exposure to credit loss in the event of

nonperformance by one of the counterparties.The interest rates payable on the foreign currency swap agree-

ments are slightly higher than the interest rates receivable on the currency exchanged, resulting in deferred inter-

est costs which are being amortized to interest expense over the term of the related agreements. The premium

costs or discounts associated with the forward contracts are being amortized over the term of the related agree-

ments and are included with the gains or losses of the hedging instrument. The unamortized balance of the net

deferred costs was $2.1 million and $3.2 million as of January 29, 2000 and January 30, 1999, respectively.

The counterparties to the forward exchange contracts and swap agreements are major international financial

institutions.The Company periodically monitors its position and the credit ratings of the counterparties and does

not anticipate losses resulting from the nonperformance of these institutions.

The fair value of the Company’s long-term debt, including current installments, is estimated using discounted

cash flow analysis based upon the Company’s current incremental borrowing rates for similar types of borrow-

ing arrangements.The fair value of long-term debt, including current installments, at January 29, 2000 approxi-

mates the carrying value of $419.7 million. These estimates do not necessarily reflect certain provisions or

restrictions in the various debt agreements which might affect the Company’s ability to settle these obligations.

E . C o m m it m e n t s

The Company is committed under long-term leases related to its continuing operations for the rental of real

estate, and fixtures and equipment. Virtually all of the Company’s leases are for a ten year initial term with

options to extend for one or more five year periods. Certain Marshalls leases, acquired in fiscal 1996, had

remaining terms ranging up to twenty-five years. Leases for T.K. Maxx are generally for fifteen to twenty-five

years with ten year kick-out options. Many of the leases contain escalation clauses. In addition, the Company is

generally required to pay insurance, real estate taxes and other operating expenses including, in some cases,

rentals based on a percentage of sales.

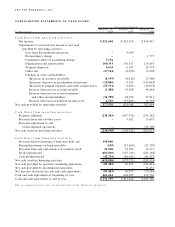

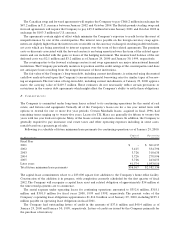

Following is a schedule of future minimum lease payments for continuing operations as of January 29, 2000:

C ap i t a l O p e r a t in g

I n Th o u s a n d s L e a s e s L e a s e s

Fiscal Year

2001 $ – $ 361,037

2002 3,415 334,796

2003 3,726 310,638

2004 3,726 278,996

2005 3,726 243,653

Later years 41,574 1,053,016

Total future minimum lease payments $56,167 $2,582,136

The capital lease commitments relate to a 283,000 square foot addition to the Company’s home office facility.

Construction of the addition is in progress, with completion currently scheduled for the first quarter of fiscal

2002.The Company will recognize a capital lease asset and related obligation of approximately $34 million at

the time rental payments are to commence.

The rental expense under operating leases for continuing operations amounted to $352.6 million, $318.1

million and $301.9 million for fiscal years 2000, 1999 and 1998, respectively. The present value of the

Company’s operating lease obligations approximates $1,814.8 million as of January 29, 2000, including $225.1

million payable on operating lease obligations in fiscal 2001.

The Company had outstanding letters of credit in the amounts of $37.6 million and $40.4 million as of

January 29, 2000 and January 30, 1999, respectively. Letters of credit are issued by the Company primarily for

the purchase of inventory.