TJ Maxx 1999 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

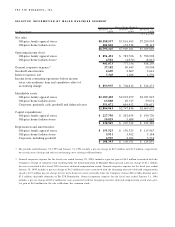

The Company had a net deferred tax asset as follows:

Ja n u a ry 2 9, Ja nu a ry 3 0 ,

I n Th o u s a n d s 2 0 0 0 1 9 9 9

Deferred tax assets:

Foreign net operating loss carryforward $ 30,107 $ 30,660

Reserve for discontinued operations 10,900 12,074

Reserve for closed store and restructuring costs 11,569 19,767

Insurance costs not currently deductible for tax purposes 1,025 7,496

Pension, postretirement and employee benefits 48,968 48,556

Leases 15,596 13,379

Other 24,709 24,255

Valuation allowance (15,678) (27,321)

Total deferred tax assets 127,196 128,866

Deferred tax liabilities:

Property, plant and equipment 19,240 17,056

Safe harbor leases 24,450 31,738

Tradename 45,408 47,373

Other 14,955 10,313

Total deferred tax liabilities 104,053 106,480

Net deferred tax asset $ 23,143 $ 22,386

The Company has elected to repatriate the fiscal 2000 and 1999 earnings of its Canadian subsidiary.The major-

ity of the fiscal 2000 and 1999 earnings from of its Canadian subsidiary were repatriated and deferred foreign

tax credits have been provided for on the undistributed portions for these years. Prior earnings of its Canadian

subsidiary and all the earnings of the Company’s other foreign subsidiaries are indefinitely reinvested and no

deferred taxes have been provided for on those earnings.

The Company has a United Kingdom and a Netherlands net operating loss carryforward of approximately $51

million and $9 million, re s p e c t i ve ly, for both tax and financial reporting purp o s e s .The United Kingdom and Nether-

lands net operating losses do not expire under the current tax laws of each country. The Company also has a

Puerto Rico net operating loss carryforward of approximately $30 million, for tax and financial reporting

purposes, which was acquired in the Marshalls acquisition and expires in fiscal years 2001 through 2003. The

Company recognized a deferred tax asset of $8.0 million and $3.4 million, in fiscal years 2000 and 1999 respec-

tively, for the estimated future utilization of the Puerto Rico net operating loss carryforward. The valuation

allowance relates to the Company’s foreign net operating losses that have not yet been recognized or are likely

to expire. Additional utilization of these net operating loss carryforwards is dependent upon future earnings of

the Company’s foreign subsidiaries.

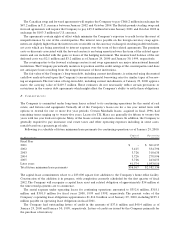

The Company ’s wo rl dwide effe c t i ve tax rate was 38% for the fiscal ye a rs ended Ja n u a ry 29, 2 0 0 0 , and Ja n u a ry 30,

1 9 9 9 , and 41% for the fiscal year ended Ja n u a ry 31, 1 9 9 8 .The diffe rence between the U. S . f e d e ral stat u t o ry income

tax rate and the Company ’s wo rl dwide effe c t ive income tax rate is summarized as fo l l ow s :

Fi scal Ye a r E n d e d

Ja n u a ry 2 9 , Ja n u a ry 3 0, Ja nu a ry 3 1 ,

2 0 0 0 1 9 9 9 1 9 9 8

U.S. federal statutory income tax rate 35% 35% 35%

Effective state income tax rate 44 5

Impact of foreign operations (1) (1) –

All other –– 1

Worldwide effective income tax rate 38% 38% 41%