TJ Maxx 1999 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company remains contingently liable for the leases of most of the former Zayre stores still operated by

Ames. The Company believes that the Company’s contingent liability on these leases will not have a material

effect on the Company’s financial condition.

The Company is also continge n t ly liable on certain leases of its former wa rehouse club operations (BJ’s Wh o l e-

sale Club and HomeBase), which was spun-off by the Company in fiscal 1990 as Waban Inc. During fiscal 1998,

Waban Inc. was renamed HomeBase, I n c . and spun-off from its BJ’s Wholesale Club division (BJ’s Wholesale Club,

I n c . ) .H o m e B a s e, I n c . and BJ’s Wholesale Club, I n c . a r e primarily liable on their re s p e c t i ve leases and have indem-

n i fied the Company for any amounts the Company may have to pay with respect to such leases. In addition,

H o m e B a s e, I n c . , B J ’s Wholesale Club, I n c . and the Company have entered into agreements under which BJ’s

Wholesale Club, I n c . has substantial indemnific ation responsibility with respect to such HomeBase, I n c .l e a s e s .T h e

C o m p a ny is also continge n t l y liable on certain leases of BJ’s Wholesale Club, I n c . for which both BJ’s Wh o l e s a l e

C l u b, I n c . and HomeBase, I n c . remain liabl e.The Company believes that its contingent liability on the HomeBase,

I n c . and BJ’s Wholesale Club, I n c . leases will not have a material effect on the Company ’s financial condition.

The Company is also contingently liable on approximately 24 store leases and the office and warehouse leases

of its former Hit or Miss division which was sold by the Company in September 1995. During the third quarter

of fiscal 1999, the Company increased its reserve for its discontinued operations by $15 million ($9 million after

tax), primarily for potential lease liabilities relating to guarantees on leases of its former Hit or Miss division.

The after-tax cost of $9 million, or $.02 per diluted share, was recorded as a loss from discontinued operations.

M . S e g m e n t I n fo r m a t i o n

The Company has two reportable segments. The off-price family apparel segment includes the T.J. Maxx,

Marshalls and A.J.Wright domestic store chains and the Company’s foreign store chains,Winners and T.K. Maxx.

The Company manages the results of its T.J. Maxx and Marshalls chains on a combined basis. The other chains,

whose operating results are managed separately, sell similar product categories and share similar economic and

other characteristics of the T.J. Maxx and Marshalls operations and are aggregated with the off-price family

apparel segment.This segment generated 8.9% of its fiscal 2000 revenue from its foreign operations.All of these

stores offer apparel for the entire family with limited offerings of giftware and domestics. The Company’s other

segment, the off-price home fashion stores, is made up of the Company’s HomeGoods stores, which offer a wide

variety of home furnishings.

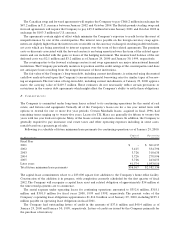

The Company evaluates the performance of its segments based on pre-tax income before general corporate

expense, goodwill amortization and interest. For data on business segments for fiscal years 2000, 1999 and 1998,

see page 22.