TJ Maxx 1999 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

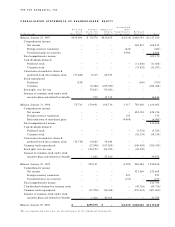

E arn in gs Pe r Sh a re : The following schedule presents the calculation of basic and diluted earnings per share

for income from continuing operations:

Fi scal Ye a r E n d e d

Ja n u a ry 2 9 , Ja n u a ry 3 0, Ja nu a ry 3 1 ,

Do ll a rs I n Th ou s a n d s E x cep t Pe r S hare A m o u n t s 2 0 0 0 1 9 9 9 1 9 9 8

(5 3 w e e k s )

Basic earnings per share:

Income from continuing operations befo re ex t ra o rd i n a ry item

and cumulat i ve effect of accounting change $526,822 $433,202 $306,592

Less preferred stock dividends –3,523 11,668

Income from continuing operations before extraordinary

item and cumulative effect of accounting change

available to common shareholders $526,822 $429,679 $294,924

Weighted average common stock outstanding

for basic earnings per share 314,577,145 318,073,081 321,474,046

Basic earnings per share $ 1.67 $ 1.35 $ .92

Diluted earnings per share:

Income from continuing operations before extraordinary

item and cumulative effect of accounting change

available to common shareholders $526,822 $429,679 $294,924

Add preferred stock dividends –3,523 11,668

Income from continuing operations befo re ex t ra o rd i n a ry item

and cumulat i ve effect of accounting change for diluted

e a r n i n g s per share calculation $526,822 $433,202 $306,592

Weighted average common stock outstanding

for basic earnings per share 314,577,145 318,073,081 321,474,046

Assumed conversion of:

Convertible preferred stock –10,914,354 24,032,172

Stock options and awards 3,213,619 5,660,515 4,105,966

Weighted average common shares for

diluted earnings per share calculation 317,790,764 334,647,950 349,612,184

Diluted earnings per share $ 1.66 $ 1.29 $ .88

The weighted average common shares for diluted earnings per share calculation at January 29, 2000 excludes

the incremental effect related to outstanding stock options whose exercise price is in excess of the average price

of the Company’s stock of $28.50 for the fiscal year.These options are excluded due to their antidilutive effect

at January 29, 2000.

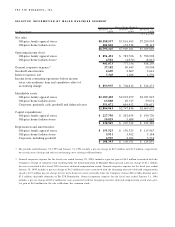

H . I n co m e Ta xe s

The provision for income taxes includes the following: Fi scal Ye a r E n d e d

Ja n u a ry 2 9 , Ja n u a ry 3 0, Ja nu a ry 3 1 ,

I n Th o u s a n d s 2 0 0 0 1 9 9 9 1 9 9 8

( 5 3 w e e k s )

Current:

Federal $255,277 $231,811 $172,026

State 49,836 45,117 39,200

Foreign 20,212 13,784 8,117

Deferred:

Federal 3,885 (13,084) (3,432)

State 1,984 (2,306) (326)

Foreign (4,079) (4,512) 94

Provision for income taxes $327,115 $270,810 $215,679