TJ Maxx 1999 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

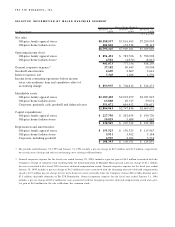

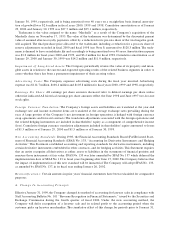

Un a u d it e d P ro Fo rm a Fisca l Ye a r E n d e d

Ja n u a ry 2 9 , Ja n u a ry 3 0, Ja n u a ry 3 1 ,

Do ll a rs I n Th ou s a n d s E x cep t Pe r S hare A m o u n t s 2 0 0 0 1 9 9 9 1 9 9 8

(5 3 w e e k s )

Income from continuing operations before extraordinary

item and cumulative effect of accounting change $513,862 $424,512 $301,129

Per diluted share $ 1.62 $ 1.27 $ .86

Net income $508,708 $415,464 $299,352

Per diluted share $ 1.60 $ 1.24 $ .85

For purposes of applying the provisions of SFAS No. 123 for the pro forma calculations, the fair value of each

option grant issued during fiscal 2000, 1999 and 1998 is estimated on the date of grant using the Black-Scholes

option pricing model with the following assumptions: dividend yield of 1% in each fiscal year, expected volatil-

ity of 46% , 40% and 38% in fiscal 2000, 1999 and 1998, respectively, a risk-free interest rate of 6.4% in fiscal

2000, 5.0% in fiscal 1999 and 5.8% in fiscal 1998, and expected holding periods of six years in all fiscal peri-

ods. The weighted average fair value of options granted during fiscal 2000, 1999 and 1998 was $14.38, $9.28

and $5.52 per share, respectively.

The effects of applying SFAS No. 123 in this pro forma disclosure are not indicative of future amounts. SFAS

No. 123 does not apply to awards prior to 1995, and additional awards in future years are anticipated.

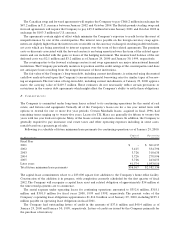

The following table summarizes information about stock options outstanding as of January 29, 2000 (shares

in thousands):

O p tio n s O u tst a n d ing O p t ions E x e rc i s a bl e

We i g h t e d

Av e r ag e W e i g h t e d W e i g h t e d

R a n g e o f R e m a i n i n g A v e r a ge A v e r ag e

E xe rcise Pr ice s S h a re s C o n t r a ct L ife E xe r cise Price S h a re s E x e r cise Price

$12.5625 - $16.3125 1,575 4.2 Years $ 5.06 1,575 $ 5.06

$16.3126 - $10.6875 2,766 6.8 Years 9.71 2,433 9.58

$10.6876 - $14.4688 2,503 7.5 Years 13.97 1,340 14.44

$14.4689 - $21.7500 1,829 8.6 Years 21.74 604 21.74

$21.7501 - $30.5000 3,159 9.6 Years 29.21 28 23.94

Total 11,832 7.6 Years $17.06 5,980 $10.77

During fiscal 1998, a special deferred compensation award was granted to the Company’s then Chief Executive

Officer, initially denominated in 900,000 shares of the Company’s stock with a fair value of $10.69 per share at

the date of grant. The shares vested at the time of the grant and the Company recorded a deferred compensa-

tion charge of $9.6 million at the time of the grant.The award provided the executive the option to periodically

denominate the shares granted into other investments. The Company was subject to income statement charges

or credits for changes in the fair market value ofTJX common stock to the extent the award, or a portion thereof,

was denominated in TJX stock. The Company recorded additional compensation expense of $1.1 million, $6.3

million and $5.6 million in fiscal 2000, 1999 and 1998, respectively, due to the increase in market value of the

shares of Company stock from date of grant.As of January 29, 2000, all of the shares have been denominated

into other investments. The Company separately transferred funds to a trust in an amount equal to the value of

the new investment elections at the time such elections were made by the executive.The trust assets are included

in other assets on the balance sheet and are invested in a manner that matches the elections made by the exec-

utive. Thus, deferred compensation adjustments due to the change in the executive’s deferred compensation

account are offset by similar amounts due to gains or losses on the trust assets.

The Company has also issued restricted stock and performance based stock awards under the Stock Incentive

Plan. Restricted stock awards are issued at par value, or at no cost, and have restrictions which generally lapse

over three to five years from date of grant.At January 31, 1998, the performance based stock awards had either

vested or been forfeited.The market value in excess of cost is charged to income ratably over the period during