TJ Maxx 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

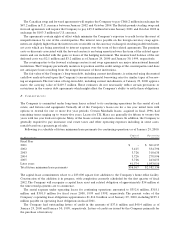

J. A c cru e d E x p e ns e s a n d O t h e r C u r re n t L ia b il it ie s

The major components of accrued expenses and other current liabilities are as follows:

Ja n u a ry 2 9 , Ja n u a ry 3 0,

I n Th o u s a n d s 2 0 0 0 1 9 9 9

Employee compensation and benefits $197,237 $173,630

Reserve for discontinued operations 27,304 29,660

Store closing and restructuring reserve, continuing operations 15,731 44,598

Insurance 26,436 44,654

Rent, utilities, advertising and other 383,630 396,451

Accrued expenses and other current liabilities $650,338 $688,993

The Company ’ s re s e rve for discontinued operations re l ates to obl i gations the Company retained or incurred in

connection with the sale of its former Zay re, Hit or Miss and Chadw i c k ’s operat i o n s . During fiscal 2000, n e t

ex p e n d i t u res of $2.3 million, re l ating primarily to lease obl i gat i o n s , reduced the re s e rve. During fiscal 1999, t h e

re s e rve increased by a net amount of $11.9 million.The Company added $15 million to the re s e rve for additional

lease re l ated obl i gat i o n s , p r i m a r i ly for Hit or Miss locat i o n s , which was offset by charges against the re s e rve in

fiscal 1999 of $3.1 million, p r i m a r i l y for charges for lease re l ated costs associated with the former Zay re store s .

The balance in the discontinued operations re s e rve of $27.3 million as of Ja n u a ry 29, 2000 is for lease re l at e d

o bl i g ations of the former Zay re and Hit or Miss locat i o n s , which are expected to reduce operating cash flows in

va rying amounts over the next ten to fifteen ye a rs , as leases reach their ex p i ration dates or are settled.

The reserve for store closings and restructurings is primarily for costs associated with the disposition and

settlement of leases for the T.J. Maxx and Marshalls closings anticipated as a result of the Marshalls acquisition.

The initial reserves established in fiscal 1996 were estimated at $244.1 million for the Marshalls store closing and

restructuring plan and $35.0 million for the closing of certain T.J. Maxx stores. The estimated cost of $244.1

million for the Marshalls closings, recorded in fiscal 1996, was reduced in subsequent years due to a reduction

in the number of planned closings and a reduction in the estimated cost of settling the related lease obligations.

Reflecting these changes, the Company reduced the total reserve by $85.9 million in fiscal 1997 with additional

adjustments reducing the reserve by $15.8 million in fiscal 1998 and $3.0 million in fiscal 2000.This reserve was

a component of the allocation of the purchase price for Marshalls and the reserve adjustments in each fiscal year

resulted in a corresponding reduction in the value assigned to the long-term assets acquired. The revised esti-

mated cost for the Marshalls closing and restructuring plan of $139.4 million, includes $67.8 million for lease

related obligations for 70 store and other facility closings, $9.6 million for property write-offs, $44.1 million for

inventory markdowns and $17.9 million for severance, professional fees and all other costs associated with the

restructuring plan. Property write-offs were the only non-cash charge to the reserve.The reserve established for

the closing of certain T.J. Maxx stores in connection with the Marshalls acquisition was initially estimated at

$35.0 million and was recorded as a pre-tax charge to income from continuing operations in fiscal 1996. Due to

lower than anticipated costs of the T.J. Maxx closings, the Company recorded a pre-tax credit to income from

continuing operations of $300,000 in fiscal 2000, $1.8 million in fiscal 1999 and $8.0 million in fiscal 1997.An

additional charge to continuing operations of $700,000 was recorded in fiscal 1998. The revised estimated cost

of the T.J. Maxx closings of $25.6 million, includes $13.5 million for lease related obligations of 32 store clos-

ings, non-cash charges of $9.8 million for property write-offs and $2.3 million for severance, professional fees

and all other costs associated with the closings.All of the Marshalls and T.J. Maxx stores identified in the plan

were closed as of January 30, 1998.

The remaining balance in the store closing and restructuring reserve as of January 29, 2000 is $15.7 million.

This balance is primarily for the estimated cost of the future lease obligations of the closed stores.The estimates

and assumptions used in developing the remaining reserve requirements are subject to change, however, TJX

believes it has adequate reserves for these obligations.The reserve also includes some activity relating to several

HomeGoods store closings, the impact of which is immaterial. The following is a summary of the activity in the

store closing and restructuring reserve for the last three fiscal years: