TJ Maxx 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

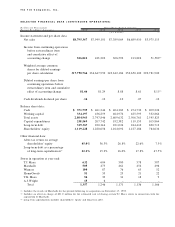

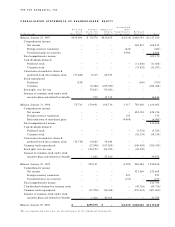

S E L E C T E D F I N A N C I A L D A T A ( C O N T I N U I N G O P E R A T I O N S )

Do llars I n Th ousa nd s Fisca l Ye ar E n de d Ja n u a r y

E x ce pt Per S h a re A m o u n t s 2 0 0 0 1 9 9 9 1 9 9 8 1 9 9 7 1 9 9 6

( 5 3 w e e k s ) (1)

Income statement and per share data:

Net sales $8,795,347 $7,949,101 $7,389,069 $6,689,410 $3,975,115

Income from continuing operations

before extraordinary item

and cumulative effect of

accounting change 526,822 433,202 306,592 213,826 51,589(2)

Weighted average common

shares for diluted earnings

per share calculation 317,790,764 334,647,950 349,612,184 350,650,100 290,781,900

Diluted earnings per share from

continuing operations before

ex t ra o rd i n a ry item and cumulat i ve

effect of accounting change $1.66 $1.29 $.88 $.61 $.15(2)

Cash dividends declared per share .14 .12 .10 .07 .12

Balance sheet data:

Cash $ 371,759 $ 461,244 $ 404,369 $ 474,732 $ 209,226

Working capital 334,197 436,259 464,974 425,595 332,864

Total assets 2,804,963 2,747,846 2,609,632 2,506,761 2,545,825

Capital expenditures 238,569 207,742 192,382 119,153 105,864

Long-term debt 319,367 220,344 221,024 244,410 690,713

Shareholders’ equity 1,119,228 1,220,656 1,164,092 1,127,186 764,634

Other financial data:

After-tax return on average

shareholders’ equity 45.0% 36.3% 26.8% 22.6% 7.5%

Long-term debt as a percentage

of long-term capitalization(3) 22.2% 15.3% 16.0% 17.8% 47.5%

Stores in operation at year-end:

T.J. Maxx 632 604 580 578 587

Marshalls 505 475 461 454 496

Winners 100 87 76 65 52

HomeGoods 51 35 23 21 22

T.K. Maxx 54 39 31 18 9

A.J.Wright 15 6 – – –

Total 1,357 1,246 1,171 1,136 1,166

( 1 ) Includes the results of Marshalls for the periods fo l l owing its acquisition on November 17, 1 9 9 5 .

( 2 ) Includes an after-tax charge of $21.0 million for the estimated cost of closing certain T. J. Maxx stores in connection with the

acquisition of Mars h a l l s .

( 3 ) Long-term cap i t a l i z ation includes share h o l d e rs’ equity and long-term deb t .

T h e T J X C o m p a n i e s , I n c .

Table of contents

-

Page 1

... shares for diluted earnings per share calculation Diluted earnings per share from continuing operations before ex t ra o rd in a ry item and cumulat ive effect of accounting change Cash dividends declared per share Balance sheet data: Cash Working capital Total assets Capital expenditures Long-term... -

Page 2

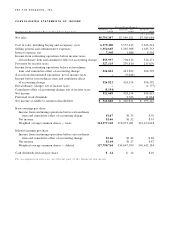

...Cost of sales, including buying and occupancy costs 6,579,400 Selling, general and administrative expenses 1,354,665 Interest expense, net 7,345 Income from continuing operations before income taxes, extraordinary item and cumulative effect of accounting change 853,937 Provision for income taxes 327... -

Page 3

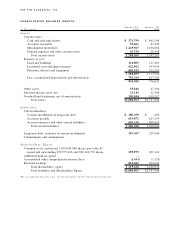

The TJX Companies, Inc. C O NS O LIDAT E D B A LAN CE SH EE T S Ja n u a ry 2 9 , 2000 Ja n u a ry 3 0 , 1999 I n Th o u sa n d s A sse t s Current assets: Cash and cash equivalents Accounts receivable Merchandise inventories Prepaid expenses and other current assets Total current assets ... -

Page 4

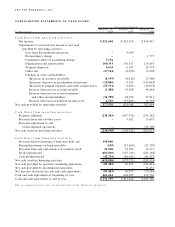

... of long-term debt, net Principal payments on long-term debt Proceeds from sale and issuance of common stock Stock repurchased Cash dividends paid Net cash (used in) ï¬nancing activities Net cash provided by (used in) continuing oper ations Net cash provided by discontinued operations Net increase... -

Page 5

... common stock Common stock repurchased Stock split, two-for-one Issuance of common stock under stock in ce n t ive plans and re lated tax beneï¬t s Balance, January 30, 1999 Comprehensive income: Net income Foreign currency translation Unrealized (loss) on securities Total comprehensive income Cash... -

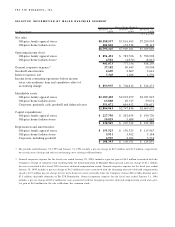

Page 6

... ED INFORMATION BY MAJOR BUSINESS SEGMENT Fi sc a l Ye a r E n d e d Ja n u a r y 3 0 , 1999 I n Th o u sa n d s Ja n u a ry 2 9 , 2000 Ja n u a r y 3 1 , 1998 ( 5 3 w e e k s) Net sales: Off-price family apparel stores Off-price home fashion stores Operating income (loss): Off-price family... -

Page 7

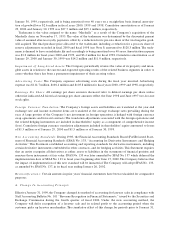

... are primarily high-grade commercial paper, institutional money market funds and time deposits with major banks. The fair value of cash equivalents approximates carrying value. During September 1999, the Company received 693,537 common shares of Manulife Financial. The shares issued reï¬,ect... -

Page 8

... 31, 1999,the Company changed its method of accounting for layaway sales in compliance with Staff Accounting Bulletin No. 101 " Revenue Recognition in Financial Statements," issued by the Securities and Exchange Commission during the fourth quarter of ï¬scal 2000. Under the new accounting method... -

Page 9

... Consolidated Statements of Income. The accounting change has virtually no impact on annual sales and earnings (before cumulative effect).However, due to the seasonal inï¬,uences of the business, the accounting change results in a shift of sales and earnings among the Company's quarterly periods.As... -

Page 10

... used in part to re p ay short-term b o r rowings and for ge n e ral corp o rate purp o se s, including the re p ayment of scheduled maturities of other outstanding long-term debt and for new store and other capital ex p e n d it u re s. In December 1999, the Company issued $200 million of 7.45% ten... -

Page 11

... leases contain escalation clauses. In addition, the Company is generally required to pay insurance, real estate taxes and other operating expenses including, in some cases, rentals based on a percenta ge of sales. Following is a schedule of future minimum lease payments for continuing operations as... -

Page 12

... note, all references to historical awards, outstanding awards and availability of shares for future grants under the Company's stock incentive plans and related prices per share have been restated, for comparability purposes, for the two-for-one stock splits distributed in June 1998 and June... -

Page 13

... charge of $9.6 million at the time of the grant. The award provided the executive the option to periodically denominate the shares granted into other investments. The Company was subject to income statement charges or credits for changes in the fair market value ofTJX common stock to the extent the... -

Page 14

... its outside directors which replaced the Company's retirement plan for directors. Each director's deferred stock account has been credited with deferred stock to compensate for the value of such director's accrued retirement beneï¬t.Additional share awards valued at $10,000 are issued annually to... -

Page 15

... stock outstanding for basic earnings per share Basic earnings per share Diluted earnings per share: Income from continuing operations before extraordinary item and cumulative effect of accounting change available to common shareholders Add preferred stock dividends Income from continuing operations... -

Page 16

... income tax rate and the Company 's worldwide effe ct ive income tax rate is summarized as fo llow s: Ja n u a ry 2 9 , 2000 Fi sc a l Ye a r E n d e d Ja n u a r y 3 0 , 1999 Ja n u a r y 3 1 , 1998 U.S. federal statutory income tax rate Effective state income tax rate Impact of foreign operations... -

Page 17

...key employees of the Company and provides additional retirement beneï¬ts based on average compensation and an unfunded postretirement medical plan which provides limited postretirement medical and life insurance beneï¬ts to associates who participate in the Company's retirement plan and who retire... -

Page 18

... ended January 29, 2000, the Company and its then Chief Executive Ofï¬cer entered into an agreement whereby the executive waived his right to beneï¬ts under the Company's nonqualiï¬ed plan in exchange for the Company's funding of a split-dollar life insurance policy. The exchange was accounted... -

Page 19

... Maxx stores in connection with the Marshalls acquisition was initially estimated at $35.0 million and was recorded as a pre-tax charge to income from continuing operations in ï¬scal 1996. Due to lower than anticipated costs of the T.J. Maxx closings, the Company recorded a pre-tax credit to income... -

Page 20

... the operating results of the Company's discontinued operations during the years ended January 29, 2000 or January 30, 1999. The cash provided by discontinued operations for ï¬scal 1998 represents the collection of the balance of the credit card receivables retained by the Company upon the sale of... -

Page 21

... limited offerings of giftware and domestics. The Company's other segment, the off-price home fashion stores, is made up of the Company's HomeGoods stores, which offer a wide variety of home furnishings. The Company e valuates the performance of its segments based on pre-tax income before general... -

Page 22

...In our opinion, the accompanying consolidated balance sheets and the re lated consolidated statements of income, sh a re h o ld e rs' equity and cash ï¬,ows present fa irly, in all material re sp e ct s, the ï¬nancial position of The TJX Compan ie s, In c. and subsidiaries (the " C o m p a ny" ) at... -

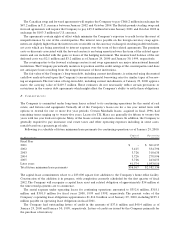

Page 23

... layaway sales, and on a full year basis has little impact on our results of operations. However, due to the seasonal inï¬,uences of the business the accounting change results in a shift of sales and earnings among our quarterly reporting periods. Presented below is a summary of the restated income... -

Page 24

... cash donation to The TJX Foundation, $3.5 million for the settlement of the Hit or Miss note receivable and $6.3 million associated with an executive deferred compensation award. These components result in a reduction in the selling, general and administrative expenses as a percentage of net sales... -

Page 25

... accounting change for layaway sales. Net income for ï¬scal 1999 includes an after-tax charge to discontinued operations of $9.0 million for lease related obligations, primarily for our former Hit or Miss stores. Fiscal 1998 includes an extraordinary charge of $1.8 million for the early retirement... -

Page 26

... of the sale of Chadwick's, TJX retained the consumer credit card receivables of the division as of the closing date, which totaled approximately $125 million, with $54.5 million still outstanding as of January 25, 1997. The balance of the receivables was collected in the ï¬rst quarter of ï¬scal... -

Page 27

... to the consolidated ï¬nancial statements for further information regarding our long-term debt, capital stock transactions and available ï¬nancing sources. TJX is exposed to foreign currency exchange rate risk on its investment in its Canadian (Winners) and European (T.K. Maxx) oper ations.As more... -

Page 28

.... PRICE RANGE OF COMMON STOCK The following per share data reï¬,ects the two-for-one stock split distributed in June 1998. The common stock of the Company is listed on the New York Stock Exchange (Symbol: TJX). The quarterly high and low trading stock prices for ï¬scal 2000 and ï¬scal 1999 are... -

Page 29

... a loss from discontinued operations relating to lease obligations, primarily for the Company's Hit or Miss stores. During the fourth quarter of ï¬scal 2000, the Company changed its method of accounting for layaway sales. (See Note A to the ï¬nancial statements.) Quarterly results for ï¬scal 2000... -

Page 30

... Chairman of the Board, The TJX Companies, Inc. Edmond J. English President and Chief Executive Ofï¬cer, The TJX Companies, Inc. Dennis F. Hightower Professor of Management, Harvard Business School Retired President, Walt Disney Television and Telecommunications Richard Lesser Executive Vice... -

Page 31

... President E xe cu t iv e Vice P re s i d e n t Edmond J. English Chairman Alex Smith Managing Director S e n io r Vice Pre sid e n t s Michael MacMillan Finance, Systems and Distibution S e n io r Vice Pre sid e n t s Gordon Bullock Store Operations, Property Development and Human Resources... -

Page 32

... New Brunswick Newfoundland Prince Edward Island Total Stores 14 4 51 14 2 2 9 2 1 1 100 E u ro p e T. K . M a x x United Kingdom Republic of Ireland Netherlands Total Stores 49 2 3 54 The HomeGoods store locations include the HomeGoods portion of a T.J. Maxx 'N More and a Marshalls Mega-Store...