Square Enix 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

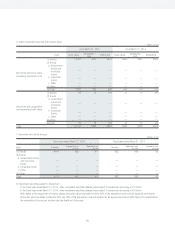

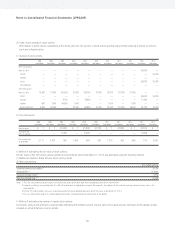

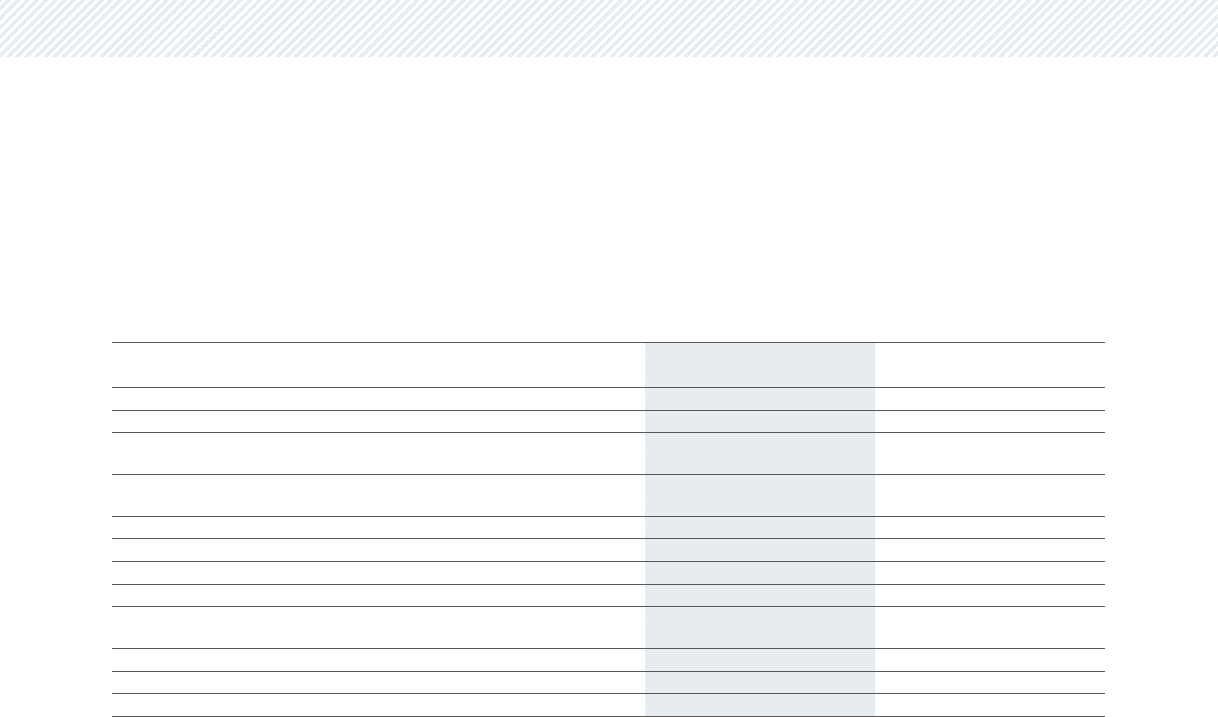

2. A reconciliation of the statutory tax rate and the effective tax rate is as follows:

As of March 31, 2015 As of March 31, 2014

Statutory tax rate

35.64% 38.01%

(Adjustments)

Permanent differences relating to entertainment expense and others excluded from

non-taxable expenses 0.33 0.77

Permanent differences relating to dividends received and others excluded from

non-taxable expenses (0.01) (0.03)

Valuation allowance (5.97) (5.25)

Taxation on a per capita basis for inhabitants’ tax 0.75 1.01

Special deduction for income growth (0.62) —

Tax credit for R&D expenses (9.13) (3.08)

Reduction of deferred tax assets and liabilities at fiscal year-end due to changes in

corporate tax rate 3.21 4.88

Differences in tax rate from the parent company’s statutory tax rate 6.95 (0.35)

Other 4.71 (1.21)

Effective tax rate 35.86 34.75

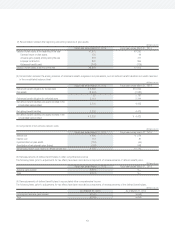

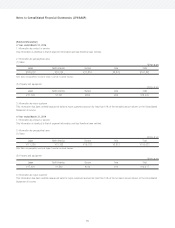

3. Revision to the amount of deferred tax assets and deferred tax liabilities due to changes in the income tax rate

With the promulgation of the “Act for Partial Amendment of the Income Tax Act, etc.” (Act No. 9 of 2015) and the “Act for Partial Amendment of the

Local Tax Act, etc.” (Act No. 2 of 2015) on March 31, 2015, income tax rates have been reduced from fiscal years beginning on or after April 1, 2015.

In accordance with these acts, the statutory tax rate used for the calculation of deferred tax assets and deferred tax liabilities has been changed from

the 35.64% applicable hitherto to 33.06% for the temporary differences likely to be eliminated in the fiscal year beginning on April 1, 2015, and to

32.30% for the temporary differences likely to be eliminated in and after the fiscal year beginning on April 1, 2016.

As a result of this change in the tax rate, the net amount of deferred tax assets (after deduction of deferred tax liabilities) decreased by ¥469

million, while income taxes–deferred, valuation difference on available-for-sale securities and remeasurements of defined benefit plans increased by

¥495 million, ¥22 million and ¥4 million, respectively, as of and for the year ended March 31, 2015.

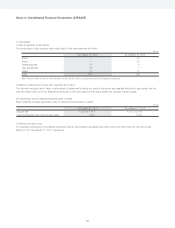

Notes to Consolidated Financial Statements (JPNGAAP)