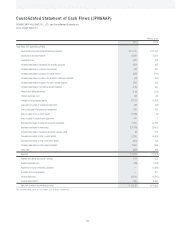

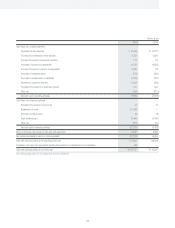

Square Enix 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

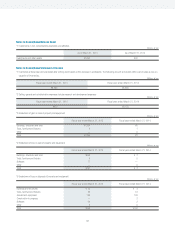

Changes in Accounting Policy

(Application of accounting standard for retirement benefi ts, etc.)

Effective from the fi scal year ended March 31, 2015, the Company has

applied the provisions specifi ed in the main clause of Paragraph 35 of the

“Accounting Standard for Retirement Benefi ts” (ASBJ Statement No. 26,

issued May 17, 2012, the “Retirement Benefi ts Accounting Standard”) and

the provisions specifi ed in the main clause of Paragraph 67 of the “Guidance

on Accounting Standard for Retirement Benefi ts” (ASBJ Guidance No. 25,

issued March 26, 2015, the “Guidance on Retirement Benefi ts”). Accordingly,

the Company has reviewed the calculation methods for retirement benefi t

obligations and service costs, and has changed the method of attributing

estimated retirement benefi ts to periods from the straight-line basis to the

benefi t formula basis. In addition, the Company has changed the method

of determining the discount rate from using the interest rates of bonds

determined by reference to the maturity closely related to the average

remaining working years of the employees, to using a single weighted

average discount rate that refl ects the estimated timing and amount of

benefi t payments.

With regard to the application of the Retirement Benefi ts Accounting

Standard, in accordance with the transitional treatment provided for in

Paragraph 37 of the Retirement Benefi ts Accounting Standard, the Company

has refl ected the effect of changing the determination methods of retirement

benefi t obligations and service costs in retained earnings at the beginning of

the fi scal year ended March 31, 2015.

As a result, net defi ned benefi t liability at the beginning of the fi scal year

ended March 31, 2015 has decreased by ¥1,811 million, while retained

earnings have increased by ¥1,683 million. The above-mentioned change in

accounting policy had minimal impact on operating income, ordinary income

and income before income taxes and minority interests for the fi scal year

ended March 31, 2015.

The impact of this change on per share information is presented in the

applicable section of these notes.

Accounting Standards Issued but Not Yet Applied

Not applicable

Change in the Method of Presentation

(Consolidated Balance Sheet)

“Income taxes receivable” was presented separately as of March 31, 2014,

but as of March 31, 2015, ¥218 million was included in “Other,” due to a

decrease in its monetary signifi cance. To refl ect this change in the method

of presentation, the consolidated fi nancial statements for the fi scal year

ended March 31, 2014 have been reclassifi ed.

Consequently, ¥288 million in “Income taxes receivable” recorded

in the consolidated balance sheet as of March 31, 2014 has been

incorporated into “Other.”

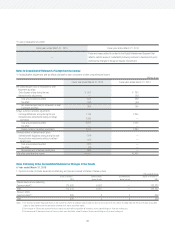

(Consolidated Statement of Cash Flows)

“Gain on sale of property and equipment” was included in “Other, net,” which

was presented separately under “Cash fl ows from operating activities,” in

the fi scal year ended March 31, 2014, but it is presented separately from

the fi scal year ended March 31, 2015, due to an increase in its monetary

signifi cance. To refl ect this change in the method of presentation, the

consolidated fi nancial statements for the fi scal year ended March 31, 2014

have been reclassifi ed.

Consequently, ¥106 million in “Other, net” recorded under “Cash fl ows

from operating activities” in the consolidated statement of cash fl ows for the

fi scal year ended March 31, 2014 has been reclassifi ed as ¥(2) million in

“Gain on sales of non-current assets” and ¥109 million in “Other, net.”

Notes to Consolidated Financial Statements (JPNGAAP)