Square Enix 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Notes Regarding Financial Instruments

1. Matters concerning financial instruments

(1) Policies regarding financial instruments

With regard to the management of funds, the Group only utilizes

financial instruments with low market risk, such as deposits.

With regard to fund procurement, the Group utilizes borrowings

from financial institutions. Forward-exchange transactions are

carried out within the amount of foreign currency-denominated

transactions conducted by the Group. It is the Group’s policy not to

engage in derivative transactions for speculative purposes.

(2) Types of financial instruments held, risks associated with these

financial instruments and the risk management system

The Group is exposed to customer credit risk through notes and

accounts receivable, which are trade receivables. The Group

endeavors to reduce this risk by managing the outstanding balance

and due date for each transaction in accordance with internal

rules at each Group company for sales management. Owing to

the Group’s global business operations, a portion of its notes

and accounts receivable are denominated in foreign currencies,

which are exposed to exchange rate fluctuation risk. Although the

Group, in principle, does not engage in derivative transactions,

for the purpose of hedging against the risk of future fluctuations

in foreign exchange rates, it enters into forward foreign exchange

contracts from time to time. Although forward foreign exchange

contracts involve exposure to exchange rate fluctuation risk, each

counterparty to these transactions is, without exception, a highly

creditworthy bank. Hence, the Group judges that credit risk through

counterparty breach of contract (counterparty risk) is negligible.

With regard to forward foreign exchange transactions, all risk is

centrally managed by the accounting division under the approval

of a representative director and the director assigned to oversee

accounting and finance matters.

Investment securities mainly comprise stock market listed

shares, and, hence, are exposed to market price fluctuation risk.

However, fair values are monitored and regularly reported to the

Board of Directors.

Guarantee deposits consist of deposits required to be furnished

by the Group when it enters into real estate leases relating to

the Group’s headquarters, other offices and amusement arcade

facilities. Although these deposits involve exposure to counterparty

credit risk, for the headquarters and other offices, and for

amusement arcades, the general affairs division and the sales

division, respectively, confirm the creditworthiness of the lessors

through regular contact. In addition, the accounting division checks

with each of these divisions on the situation at the end of each

fiscal year.

Notes and accounts payable are defined as those trade

payables due within one year. Short-term loans are used to meet

short-term working capital requirements. The Group avoids the

settlement liquidity risk associated with short-term payables,

including notes and accounts payable, accrued corporate taxes and

short-term loans, through the monthly review of its funding plan

and other methods. Although foreign currency-denominated trade

payables involve exposure to exchange rate fluctuations, the Group

reduces this risk through similar methods to those used to manage

the risk associated with foreign currency-denominated trade

receivables. The Group is exposed to interest rate risk through

short-term loans. The Group, however, is able to respond flexibly to

interest rate fluctuations since the borrowing periods are short.

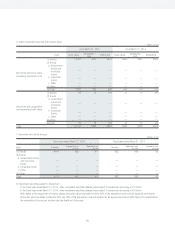

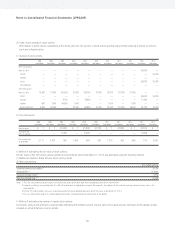

In terms of derivative transactions, the Group mainly uses

forward foreign exchange contracts as hedging instruments in

order to hedge the risk of fluctuations in foreign exchange rates

relating primarily to business transactions denominated in foreign

currencies.

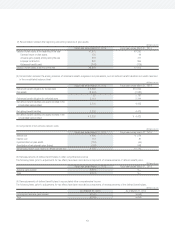

(3) Supplementary information regarding the fair value, and others, of

financial instruments

The fair value of financial instruments includes amounts based

on market prices as well as those calculated using an appropriate

formula when there is no applicable market price. Since variable

factors are included in the calculation of such fair values, the

adoption of different assumptions may lead to changes in these

fair value amounts. The contract amounts, etc., of derivative

transactions discussed in “Derivative Transactions” of the Notes do

not indicate the market risk associated with derivative transactions.

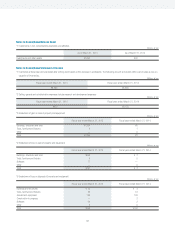

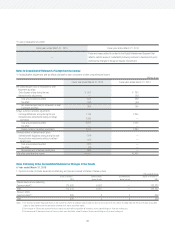

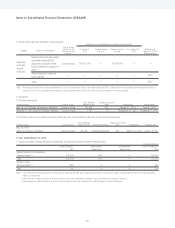

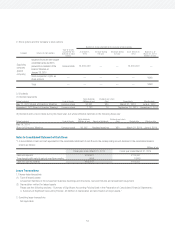

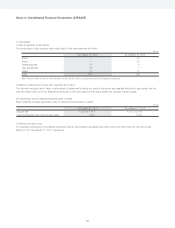

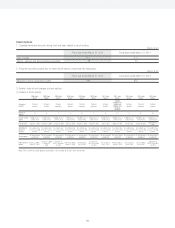

2. Fair value of financial instruments

With regard to financial instruments held by the Company and its

consolidated subsidiaries, the values presented on the consolidated

balance sheet as of March 31, 2015 and 2014, the estimated fair

value and the difference between these amounts are as follows.

Items for which fair value is difficult to estimate are not included in

the following table (Note 2).

Notes to Consolidated Financial Statements (JPNGAAP)