Shutterfly 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Contingencies

From time to time, the Company may have certain contingent liabilities that arise in the ordinary course of

its business activities. The Company accrues contingent liabilities when it is probable that future expenditures

will be made and such expenditures can be reasonably estimated.

Syndicated Credit Facility

On November 22, 2011, the Company entered into a credit agreement (“Credit Agreement”) with J.P.

Morgan Securities LLC, Wells Fargo Securities, LLC, Fifth Third Bank, Silicon Valley Bank, US Bank and

Citibank, N.A. (“the Banks”). JPMorgan Chase Bank, N.A. acted as administrative agent in the Credit

Agreement. The Credit Agreement is for five years and provides for a $125.0 million senior secured revolving

credit facility (the “credit facility”) and if requested by the Company, the Banks may increase the credit facility

by $75.0 million subject to certain conditions. In December 2013, the Company requested and received the entire

incremental amount for a total credit facility of $200.0 million. As part of the expansion, Bank of America, N.A.

and Morgan Stanley Bank, N.A. joined the syndicate. From inception through December 31, 2015, the Company

has not drawn on the credit facility.

At the Company’s option, loans under the Facility will bear stated interest based on the Base Rate or

Adjusted LIBO Rate, in each case plus the Applicable Rate (respectively, as defined in the Credit Agreement).

The Base Rate will be, for any day, the highest of (a) 1/2 of 1% per annum above the Federal Funds Effective

Rate (as defined in the Credit Agreement), (b) JPMorgan Chase Bank’s prime rate and (c) the Adjusted LIBO

Rate for a term of one month plus 1.00%. Eurodollar borrowings may be for one, two, three or six months (or

such period that is 12 months or less, requested by Intersil and consented to by all the Lenders) and will be at an

annual rate equal to the period-applicable Eurodollar Rate plus the Applicable Rate. The Applicable Rate for all

revolving loans is based on a pricing grid ranging from 0.500% to 1.25% per annum for Base Rate loans and

1.50% to 2.250% for Adjusted LIBO Rate loans based on the Company’s Leverage Ratio (as defined in the

Credit Agreement).

On May 10, 2013, the Company amended the Credit Agreement by and among the Company and the Banks

to (i) permit the issuance of the Notes and the related Note Hedge and Warrant, (ii) amend certain of the

restrictive covenants set forth in the Credit Agreement, (iii) increase the Leverage Ratio (as defined the Credit

Agreement) to be maintained by the Company to be at or below 3.50 to 1.00, and (iv) add a covenant requiring

that the Company not permit its Senior Secured Leverage Ratio (as defined in the Credit Agreement) to exceed

1.60 to 1.00. Unchanged from the initial credit agreement, the Credit Agreement contains customary

representations and warranties, affirmative and negative covenants, and events of default. Also, the Company

may not permit the ratio of its Consolidated EBITDA for any period of four consecutive fiscal quarters to its

interest and rental expense and the amount of scheduled principal payments on long-term debt, for the same

period, to be less than 2.50 to 1.00. As of December 31, 2015, the Company is in compliance with all of its

covenants.

Amounts repaid under the Facility may be reborrowed. The revolving loan facility matures on the fifth

anniversary of its closing and is payable in full upon maturity. The Company intends to use the new Facility from

time to time for general corporate purposes, working capital and potential acquisitions.

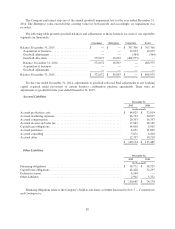

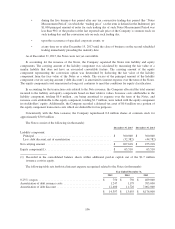

The Company incurred $0.5 million of Credit Facility origination costs during the year ended December 31,

2013, related to the amendment and extension of the agreement. These costs have been capitalized within prepaid

expenses for the current portion and other assets for the non-current portion. These fees are being amortized over

the remaining term of the Credit Facility as a component of interest expense.

96