Shutterfly 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s Board of Directors includes Michael Zeisser who was appointed to XO Group Inc.’s (“XO

Group”) Board of Directors in July 2013. During the year ended December 31, 2015, the Company conducted

business with XO Group which consisted of various marketing campaigns. The Company paid XO Group

approximately $1.8 million, $1.4 million, and $0.8 million during the years ended December 31, 2015, 2014 and

2013, respectively. The Company had a payable balance of approximately $0.2 million as of December 31, 2015

and 2014 with XO Group.

Management believes that these transactions are at arms length and on similar terms as would have been

obtained from unaffiliated third parties.

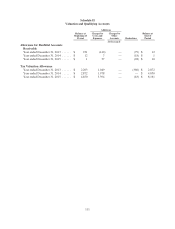

Note 15 — Restructuring

During the first quarter of 2015, the Company decided to discontinue the Treat brand as well as close the

manufacturing operations in Elmsford, New York as part of the Company’s strategic initiatives. The assets

related to the Treat brand were written off in the first quarter of 2015 upon discontinuation of the Treat brand. In

the third quarter of 2015, the Company stopped production at the Elmsford, New York manufacturing facility

and ceased-use of the manufacturing space. As a result of exiting the facility prior to the lease termination date,

the Company recorded a liability of $2.1 million the net present value of future rent payments, adjusted for

potential sublease income. The Company will continue to incur employee severance and benefit expenses due to

a reduction to headcount as a result of the restructuring activities. These restructuring costs will impact cost of

net revenues and operating expenses through the first quarter of 2016.

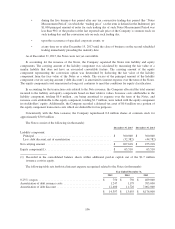

The following table summarizes the restructuring costs recognized during the year ended December 31,

2015:

Year Ended

December 31, 2015

(in thousands)

Employee severance and benefits ................................................. $ 1,043

Other associated costs .......................................................... 2,494

Total ........................................................................ $ 3,537

The following table summarizes the restructuring activity during the year ended December 31, 2015:

Employee Severance

and Benefits

Other Associated

Costs Total

Accrued liability as of January 1, 2015 ............ $ — $ — $ —

Charges .................................. 1,043 2,494 3,537

Payments ................................. (577) — (577)

Other adjustments .......................... — (435) (435)

Accrued liability as of December 31, 2015 ......... $ 466 $ 2,059 $ 2,525

109