Shutterfly 2015 Annual Report Download - page 83

Download and view the complete annual report

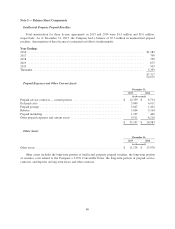

Please find page 83 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For gift card sales and flash deal promotions through group buying websites, the Company recognizes

revenue on a gross basis, as it is the primary obligor, when redeemed items are shipped. Revenues from sales of

prepaid orders on its websites are deferred until shipment of fulfilled orders or until the prepaid period expires.

The Company’s share of revenue generated from its print to retail relationships, is recognized when orders are

picked up by its customers at the respective retailer.

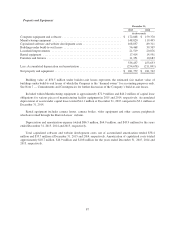

In the second quarter of 2015, the Company changed its accounting estimate related to flash deal deferred revenue.

Beginning in 2010, the Company began to market product offers on flash deal websites such as Groupon and

LivingSocial. With limited history as to customer redemption patterns, the Company had been deferring all amounts to

a flash deal deferred revenue liability until customer redemption. The Company now has sufficient relevant historical

flash deal redemption data to support a change in estimate of the flash deal deferred revenue based on historical

customer redemption patterns. The historical data supports the probability of redemption after two years from the

issuance of a flash deal offer as remote. In addition, the Company’s attempts to re-market the unredeemed flash deals

over the last six months resulted in no meaningful change in customer behavior. Accordingly, flash deal breakage

revenue is now recognized based upon its historical redemption patterns and represents the unredeemed flash deal

offers for which the Company believes customer redemption is remote and it is not probable that the Company has an

obligation to escheat the value of the flash deal revenue under unclaimed property laws. During the year ended

December 31, 2015, the Company recognized revenue of $10.0 million associated with this change.

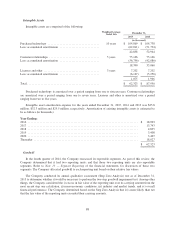

The Company provides its customers with a 100% satisfaction guarantee whereby products can be returned

within a 30-day period for a reprint or refund. The Company maintains an allowance for estimated future returns

based on historical data. The provision for estimated returns is included in accrued expenses.

The Company periodically provides incentive offers to its customers in exchange for setting up an account

and to encourage purchases. Such offers include free products and percentage discounts on current purchases.

Discounts, when accepted by customers, are treated as a reduction to the purchase price of the related transaction

and are presented in net revenues. Production costs related to free products are included in cost of revenues upon

redemption.

The Company’s advertising revenues are derived from the sale of online advertisements on its websites.

Advertising revenues are recognized as “impressions” (i.e., the number of times that an advertisement appears in

pages viewed by users of the Company’s websites) are delivered; as “clicks” (which are generated each time

users of the Company’s websites click through the advertisements to an advertiser’s designated website) are

provided to advertisers; or ratably over the term of the agreement with the expectation that the advertisement will

be delivered ratably over the contract period.

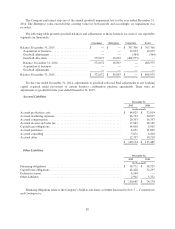

Certain Enterprise revenue arrangements with multiple deliverables, including products and services, are

divided into separate units and revenue is allocated using estimated selling prices if we do not have vendor-

specific objective evidence or third-party evidence of the selling prices of the deliverables. The Company

allocated the arrangement price to each of the elements based on the relative selling prices of each element.

Estimated selling prices are management’s best estimates of the prices that the Company would charge our

customers if the Company were to sell the standalone elements separately and include considerations of customer

demand, prices charged by the Company and others for similar deliverables, and the price if largely based on the

cost of producing the product or service. For up-front fees the Company received in exchange for products

delivered or services performed, it is deferred and recognized over periods that the fees are earned. In cases in

which an up-front fee is not related to specific products or services, the fee is excluded from the consideration

that is allocated to the deliverables, and be recognized over the longer of the initial contractual term of the

arrangement or the estimated period the customer is expected to benefit from the payment of the up-front fee.

81