Shutterfly 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

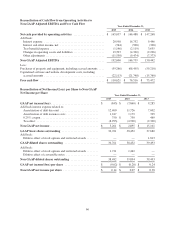

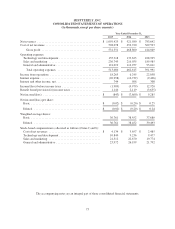

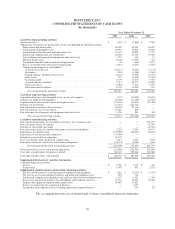

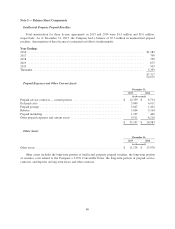

SHUTTERFLY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2015 2014 2013

Cash flows from operating activities:

Net income/(loss) ......................................................... $ (843) $ (7,860) $ 9,285

Adjustments to reconcile net income/(loss) to net cash provided by operating activities:

Depreciation and amortization ............................................. 86,290 64,885 43,887

Amortization of intangible assets ........................................... 26,987 33,867 30,969

Amortization of debt discount and transaction costs ............................ 13,647 12,905 7,707

Stock-based compensation, net of forfeitures .................................. 60,458 61,762 53,528

Loss on disposal of property and equipment and rental assets ..................... 1,755 361 13

Deferred income taxes ................................................... (2,149) (2,604) 331

Tax benefit/(shortfall) from stock-based compensation .......................... 98 (163) 2,957

Excess tax benefits from stock-based compensation ............................ (1,813) (1,025) (3,635)

Changes in operating assets and liabilities:

Accounts receivable, net ................................................ (24,117) (9,464) (7,174)

Inventories ........................................................... (450) (3,388) (3,681)

Prepaid expenses and other current assets .................................. (8,163) (3,958) (4,347)

Other assets .......................................................... 727 (1,442) (7,669)

Accounts payable ..................................................... 3,139 (1,275) 3,583

Accrued and other liabilities ............................................. 5,211 18,273 16,089

Deferred revenue ...................................................... (4,085) 7,301 5,258

Other non-current liabilities ............................................. 8,345 (1,687) 167

Net cash provided by operating activities ................................. 165,037 166,488 147,268

Cash flows from investing activities:

Acquisition of business and intangible assets, net of cash acquired ................... (127) (12,000) (76,893)

Purchases of property and equipment .......................................... (55,448) (71,169) (62,582)

Capitalization of software and website development costs ......................... (21,221) (21,032) (15,760)

Purchases of investments ................................................... (31,073) (124,111) —

Proceeds from the maturities of investments .................................... 62,944 29,130 —

Proceeds from the sales of investments ........................................ 10,510 850 —

Proceeds from sale of property and equipment and rental assets ..................... 1,298 904 388

Net cash used in investing activities ..................................... (33,117) (197,428) (154,847)

Cash flows from financing activities:

Proceeds from borrowings of convertible senior notes, net of issuance costs ........... — — 291,897

Proceeds from issuance of warrants ........................................... — — 43,560

Purchase of convertible note hedge ........................................... — — (63,510)

Proceeds from issuance of common stock upon exercise of stock options .............. 3,221 3,243 19,112

Repurchases of common stock ............................................... (179,090) (88,815) (32,241)

Prepayment of accelerated share repurchase .................................... (75,000) — —

Refund of accelerated share repurchase ........................................ 38,179 — —

Excess tax benefits from stock-based compensation .............................. 1,813 1,025 3,635

Principal payments of capital lease and financing obligations ....................... (12,723) (3,054) (878)

Net cash provided by/(used in) financing activities ......................... (223,600) (87,601) 261,575

Net increase/(decrease in) cash and cash equivalents .............................. (91,680) (118,541) 253,996

Cash and cash equivalents, beginning of period .................................. 380,543 499,084 245,088

Cash and cash equivalents, end of period ....................................... $ 288,863 $ 380,543 $ 499,084

Supplemental disclosures of cash flow information:

Cash paid during the period for:

Interest ................................................................ $ 6,256 $ 1,133 $ 466

Income taxes ........................................................... 1,056 667 2,158

Supplemental schedule of non-cash investing / financing activities:

Net increase/(decrease) in accrued purchases of property and equipment ............ $ 3,818 $ (2,674) $ (3,372)

Net increase in accrued capitalized software and website development costs ......... 892 716 —

Stock-based compensation capitalized with software and website development costs . . 1,247 1,597 1,709

Increase in estimated fair market value of buildings under build-to-suit leases ........ 17,161 22,855 10,080

Property and equipment acquired under capital leases ........................... 29,097 37,823 —

Increase to amount due for acquisition of business ............................. — 1,673 —

Amount due from adjustment of net working capital from acquired business ......... — 253 10

The accompanying notes are an integral part of these consolidated financial statements.

76