Shutterfly 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

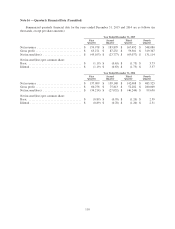

Restricted Stock Units

The Company grants restricted stock units (“RSUs”) to its employees under the provisions of the 2006 Plan,

2015 Plan and inducement awards to certain new employees upon hire in accordance with NASDAQ Listing

Rule 5635(c)(4). The cost of RSUs is determined using the fair value of the Company’s common stock on the

date of grant. RSUs typically vest and are settled annually, based on a three or four year total vesting

term. Compensation cost is amortized on a straight-line basis over the requisite service period.

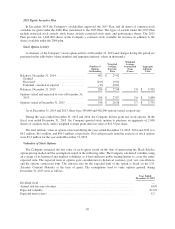

Restricted Stock Unit Activity

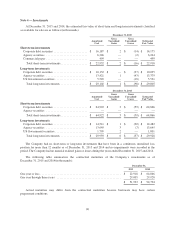

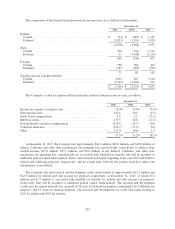

A summary of the Company’s restricted stock unit activity for the year ended December 31, 2015, is as

follows (share numbers in thousands):

Number

of

Units

Outstanding

Weighted

Average

Grant Date

Fair Value

Awarded and unvested, December 31, 2014 ................................... 3,704 $ 42.17

Granted .............................................................. 2,412 44.43

Vested ............................................................... (1,617) 39.90

Forfeited ............................................................. (1,349) 43.99

Awarded and unvested, December 31, 2015 ................................... 3,150 $ 44.28

Restricted stock units expected to vest, December 31, 2015 ....................... 2,714

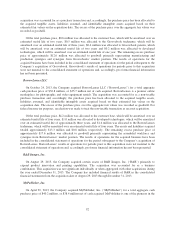

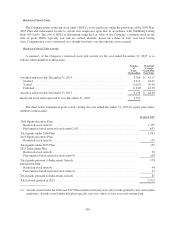

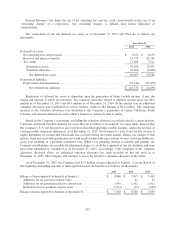

The chart below summarizes grant activity during the year ended December 31, 2015 by equity plan (share

numbers in thousands):

Grants in 2015

2006 Equity Incentive Plan

Restricted stock units(1) ......................................................... 1,355

Performance-based restricted stock units(2)(3) ....................................... 637

Total grants under 2006 Plan ....................................................... 1,992

2015 Equity Incentive Plan

Restricted stock units(1) ......................................................... 155

Total grants under 2015 Plan ....................................................... 155

2015 Inducement Plan

Restricted stock units(4) ......................................................... 70

Performance-based restricted stock units(4) .......................................... 108

Total grants pursuant to Inducement Awards ........................................... 178

Inducement Plan

Restricted stock units(4) ......................................................... 44

Performance-based restricted stock units(4) .......................................... 43

Total grants pursuant to Inducement Awards ........................................... 87

Total awards granted in 2015 ....................................................... 2,412

(1) Awards issued under the 2006 and 2015 Plan include restricted stock unit awards granted to new and current

employees. Awards issued under this plan typically vest over a three or four year total vesting term.

100